2023 Business Forecast

2023 Business Forecast

Distributor Forecast

Jump to the Supplier Forecast

Growth Ahead in 2023 But Uncertainty Abounds

Economic headwinds like inflation and supply chain shortages temper expectations.

By Steve Guglielmo

Every year in the 1st Quarter Issue of Welding & Gases Today, we reach out to all GAWDA members to try to get a sense of the economic landscape for the upcoming year. We speak not only to GAWDA distributors and suppliers, but also to GAWDA’s Chief Economists at ITR Economics, and sister organizations American Welding Society and the Compressed Gas Association. Taken together, we can paint a complete picture of how the industry will shake out in 2023. And this year, we see some very clear trends emerge. While there are near-unanimous calls for growth, the expectations are tempered by continuing trends like supply chain shortages, challenges finding skilled labor, residual inflation, and expectations of a potential recession in the second-half of the year.

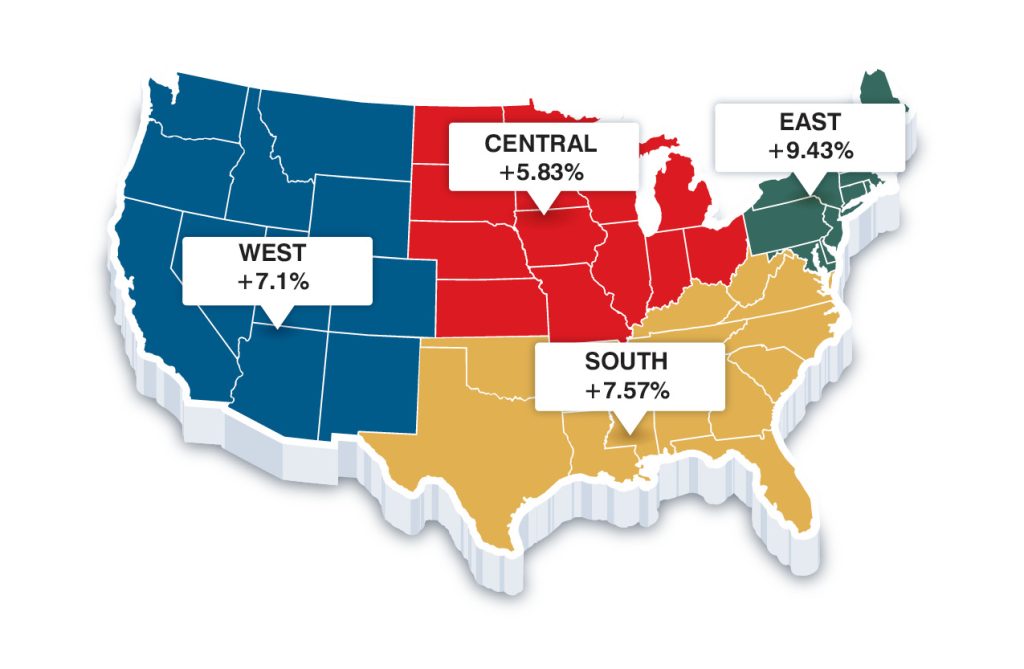

Continuing this year, we have broken down the distributor forecast by region. This reflects the fact that prevailing industries in each region are different and problems facing distributors in the Northeast may be vastly different than those seen in Texas. Not every region is experiencing the same economic climate at the same time. As it was in 2022, GAWDA’s distributors are up across the board this year, with every region projecting growth, though with caveats and contingencies.

The following are responses from GAWDA distributors across North America about what they expect to see in 2023. Thank you to those who participated.

East

The last two years, the Eastern region of the country has projected the lowest growth among GAWDA members. In 2021, the region actually predicted negative growth, as COVID restrictions took a major toll on businesses in the northeast. With a -0.5% projection in 2021, and a 5.62% growth projection in 2022, this year represents a leap forward for the region, as cumulatively, the Eastern U.S. projects 9.43% growth in 2023, the highest projected region this year, after being the lowest region the past two years.

Colleen Kohler, CEO

Noble Gas Solutions

“Managing and holding our sales team accountable has been one of the main ways that we achieve large growth numbers year over year,” says Noble Gas CEO Colleen Kohler. “Training our team on how to provide exceptional technical support and value added selling is how we accomplish our targets. Our customers value us as business partners in industry because we deliver top of the line customer service.” Kohler notes that CO2 is a major issue in the northeast. “It is hard to find supply at a competitive price, so it takes a lot of management and oversight to make sure we are taking care of our current customers the best we can,” she says. She concludes, “Noble is always looking to expand in any way that makes business sense to us. We are always open to working with our suppliers to be trained on new products to sell. Being on the cutting edge always helps us grow and gain confidence in our customers.”

Ralph M. Cohan, VP of Sales/Operations

General Welding Supply Corporation

Though General Welding Supply Corporation anticipates the instability of gas supplies to persist in 2023, the company expects to see sales growth in 2023 of 5-8%. This year marks General Welding Supply’s centennial anniversary. Says Cohan, “We continue to focus on what has helped us standout from our competition, service! Eliminate customers’ struggles to move their business forward and you are commonly rewarded with loyalty.” As others have noted, the CO2 shortage continues to wreak havoc in the region. “Being in a service driven environment and servicing the larger hospital networks in the region, we find ourselves dependent upon the high volume, low priced market, so supply disruptions in such products as medical grade CO2 present issues,” says Cohan. “We still have hopes of getting this behind us.” Overall, 2023 should be a positive year as General Welding begins its second century.

Stephen Nichols, Owner

ArcSource, Inc.

Increased prices and new lines will help push ArcSource, Inc. to a projected 8% increase in 2023, according to Owner Stephen Nichols. This is in-line with a projected increase for the gases and welding industry this year.

John Larsen, Vice President

West Penn Laco

As others have noted, persisting supply chain issues will

continue to impact growth opportunities in 2023. For West Penn Laco, Vice President John Larsen anticipates a 3-5% growth over 2022. “We try to control expenses to keep price increases to a minimum,” he says. “We shop around for suppliers more frequently and factor in all costs (e.g. shipping, rebates, etc.) in each purchase more closely.” He continues, “There have been opportunities for those like us that have inventory and have people to get products to customers. The industries vary, but recently the new opportunities outnumber the businesses that are slowing or closing. Overall, more manufacturing moving back to the U.S. will be good for everyone in the industry. We are always looking for opportunities to expand our business. We think this is a very good time, since many competitors have struggled with staffing and inventory, to gain new business.” The company expanded its geographic footprint about four years ago and continue to develop that area post-COVID, which will also help drive future growth.

Lloyd Robinson, President

AWISCO

“AWISCO is adding an ecommerce store to better serve our customers,” says President Lloyd Robinson. “AWISCO also decided to increase our inventory levels, to create a cushion due to increased lead times.” These factors, combined with anticipated projects that will be funded by the infrastructure bill, lead AWISCO to project a 4-6% growth in 2023. “AWISCO is always looking to expand hopefully we will be able to continue to grow in 2023, by making an acquisition or two,” Robinson says. “AWISCO continues to expand the boundaries of our existing geography.” In January of this year, AWISCO expanded in Toms River, NJ.

David Goldstein, Controller

AGL Welding Supply

David Goldstein, Controller at AGL Welding Supply, anticipates a 12-20% growth for the company in 2023. “As we are a customer-focused company first and foremost, we have always seen loyalty to our business. Especially with the current economic and health climates, that customer-first approach has shined a bright light on the future,” Goldstein says. The company added e-commerce capabilities, which has helped bolster its growth projections. Goldstein adds, “We are always looking and evaluating both expansion of facilities and potential product offerings.”

Matthew J. Sunde, Assistant Treasurer

Middlesex Gases & Technologies

Growth into surrounding areas and regions will help contribute to an expected 5-8% increase for Middlesex Gases & Technologies in 2023. Assistant Treasurer Matthew J. Sunde notes that the company is, “fortunate to be part of the growing bio/life science industries,” which are expected to see growth this year. As others have noted, “CO2 has been challenging over the last couple of years. We heard positive options might be available heading into Q1 2023 and beyond.” The company is well-positioned for growth heading into its 75th Anniversary in 2024.

Central

As it has the past two years, the Central region of the country accounted for the most survey results. And while the results in 2021 and 2022 were strikingly similar (8.37% growth in 2021 and 8.9% growth in 2022), this year sees a marked shift in optimism, with the Central Region being the least optimistic region surveyed, clocking in at 5.83% expected growth.

Gary Halter, President

Indiana Oxygen

“The past three or four years, we have budgeted for single-digit growth, but we’ve been surprised each of those years by growing our business 10% or more,” says Indiana Oxygen President Gary Halter. “Based on past growth and a strong list of prospects, we are looking at 8% growth in 2023.” He continues, “The enormous rise in energy costs have led to very large cost increases from our gas suppliers. The economy and the health of our customers will obviously have an impact as well. Educating our customers about this situation, in hopes of passing this cost along, while preserving our trust and credibility with them, will be the number one challenge as we head into 2023. I don’t feel that our customer service will be at risk. Product supply with helium and CO2 is a concern as well.” He concludes, “Recently, a well-respected independent adjacent to our traditional market sold to one of the top majors. As luck would have it, those customers had been weened for decades on the ability to transact with the owners. When the owners jumped ship – the day they turned over the keys to the new owner – a surprising number of customers went looking for a new independent with which to do their gas business. We have started two new stores in their back yard to accommodate those customers.” As it has always done, Indiana Oxygen will continue to expand its offerings to improve its value proposition, including its new equipment repair division.

Eric Wood, COO

O.E. Meyer Co.

“Our customers’ needs to purchase capital equipment and welding and cutting automation will dictate the percentage growth in 2023,” says O.E. Meyer COO Eric Wood. “We are fortunate to have many large capital equipment projects quoted with our customers with high probability of closing in 2023.” The company has made significant investments toward improvements to its e-commerce platform, its website and SEO, which have helped drive business since COVID. In 2023, O.E. Meyer will purchase six acres to relocate and expand of its locations to a more desirable area that will not only improve customer experience, but also give its current future employees a better area to work in. Wood concludes, “We have made investments in infrastructure and with new employee owners to strengthen and expand into new markets and capitalize on opportunities and market share in markets already established.”

Joe Winkle, Owner

Weldstar

Weldstar expects to see a 10% growth in 2023, even in the face of a possible recession, according to Owner Joe Winkle. He notes that, “We have embraced technology. We believe the labor market will be outpaced by output. Thus, we will need to fill that gap by being more productive. The only way to do that is through innovation and technology.” He continues, “The two disruptors, like most areas, are the supply chain disruptions and inflation. We believe that companies who planned for such an environment will have advantages moving forward. Our region is predominately manufacturing in many forms. We believe manufacturing will remain strong for the first half of 2023.” In recent years, Weldstar has opened offices in three new locations, which will contribute to its long-term growth strategies.

Scott Myran, President

Mississippi Welders Supply Company

MWSCO anticipates a growth of 5% in 2023 “if conditions slip a bit,” but could see growth of 8-10% “if we see favorable changes in employment, interest rates, and energy,” says President Scott Myran. “MWSCO is a stakeholder in Absolute Air. After delays in launching the plant in 2022, we know we’ll be producing LIN, LOX, LAR in 2023, giving us much greater control of a large segment of our supply chain,” he says. “We’re always ready to expand to underserved markets. Market research never ceases, when opportunities for expansion are ready for primetime, we’ve proven multiple times we can go to market quickly and effectively.” The company opened a new branch in Appleton, Wisconsin, in 2022, a market that had been on its radar for several years. That new branch will be a long-term growth driver for MWSCO.

Brad Davis, General Manager

Central Ohio Welding, Inc.

“We expect our company to grow between 7-10% in 2023,” says Central Ohio Welding General Manager Brad Davis. “Most metro areas in Ohio, including the ones we service, are seeing steady growth from manufacturers adjusting their supply chains and investing in automation.” Central Ohio has multiple large construction projects that are starting in 2023 related to Semiconductors and Green Energy. These projects, as well as considerable investments in manufacturing throughout Ohio give the company confidence that this will still be a decent year in spite of forecasts for a potential downturn. “Our biggest issue in Ohio is that we do not have enough labor to fill the Welding, Machining, and Driving positions within the state,” Davis says. “At the same time, we have a lot of companies that would like to expand production. This affects growth considerably.” He concludes, “The biggest changes we have made the past three years are how we rate our suppliers and how we pick our target customers. In our markets, the ways we used to business are going away so quickly we need to have the right partners at both ends.”

John D’Amaro, CFO

ILMO Products Company

In the face of supply chain issues, gas shortages, and the ongoing labor challenges, ILMO Products company still anticipates growth of 7%- 10% in 2023, according to CFO John D’Amaro. The company projects some market segments will be up while others will be down. “While not a new market, we are seeing some growth in the propane segment of our business, driven by geographic expansion,” D’Amaro says. 2023 is shaping up to be an exciting year for ILMO, as the distributor celebrates its 110th anniversary this year.

Jon Berger, President

Berger Farm & Welding Supply

Two large customers signed contracts in December 2022 that really set the tone for a strong year for Berger Farm & Welding Supply. President Jon Berger projects a robust 20% increase for Berger this year, even as the industry itself will remain flat. He notes, “stocking levels have had to increase due to supply shortages.” The RV and trailer industry, one that Berger does a lot of business in, will see a down year compared to the last two years, according to Berger. Even with that factored in, 2023 still projects to be a strong year for the company.

Robert Kurvers, VP of Sales and Marketing

Toll Company

Robert Kurvers, VP of Sales and Marketing for Toll Company, expects sales to be down in 2023, compared to 2022. “Large rare gas orders will be limited, as will expensive helium purchases,” Kurvers says. He notes that Toll continues to target markets for its welding cobots. Toll is also part of the cooperative that opened Absolute Air in 2023, which will allow the company to target bulk gas markets. During COVID, Toll enhanced its websites and added third-party phone and email campaigns to target prospects to gain engagements, set up appointments, and gather information, efforts which will continue to pay off this year.

South

Last year, the South was overwhelmingly the most optimistic region of the country, with an expected 11.74% growth. This year, responses weren’t quite as optimistic, but the region still clocked in as the second most optimistic, with a projected growth of 7.57% in 2023.

Allen Jezouit, Vice President, Product Management & Digital Marketing

Meritus Gas Partners

“Sales will be up due to price increases, offset by modest volume declines later in the year,” predicts Meritus Gas Partners Vice President of Product Management & Digital Marketing Allen Jezouit. “We are paying close attention to helium and CO2 sourcing costs. CO2 pricing may be drastically impacted by the increase in the 45Q tax credits in the Inflation Reduction Act and the proliferation of sequestration. Helium Shortage 4.0 remains underway, although the supply situation is currently stable. The labor market remains tight, especially for truck drivers.” The company’s primary business model is to expand through target acquisitions, which will continue in 2023. Concludes Jezouit, “Demand will taper off later in the year as the forecast recession takes hold. Timing of that drop-off is difficult to predict as current demand remains strong.”

John Hill, President

Willard C. Starcher, Inc.

Though inflation and an overall uncertain economy are worrisome, Willard C. Starcher President John Hill still expects to see 6% growth for the company in 2023. “We have taken a much closer look at our delivery costs,” Hill notes. “The oil and gas industry is the dominant industry in our delivery area. The pipeline industry has been greatly impacted by government policies. But I don’t expect to see much change in this market this year.” Overall, even in the face of strong headwinds, Hill expects to see growth for the industry in the coming year.

Robert McNeely, Purchasing Agent

Shaw Oxygen

Shaw Oxygen continues its search to add reliable vendors to combat the ongoing inconsistences in the supply chain, according to Purchasing Agent Robert McNeely. The company also continues to raise costs when necessary, while simultaneously looking for ways to cut costs. All of this will help contribute to a projected 5% growth in 2023. Says McNeely, “We have added new product lines. And, more importantly, we are being more attentive to customer demands by providing concierge service, setting us apart from our competition. We are well-versed in explaining our product lines and why it is beneficial to buy from us.” The company has recently entered CO2 sales, which it anticipates will be a growth driver going forward. Barring potential political instability, 2023 projects to be a year of modest growth for Shaw.

David Rimes, Owner

Lake Welding Supplies

Lake Welding Supplies has increased its inventory, which will help contribute to an expected 10% growth in 2023. As others have noted, “inflation is really hurting our bottom line,” says Owner David Rimes. Like others in the South, farming is a primary industry for Lake Welding Supplies and will be a large determinant on if the company is able to realize its projected growth in 2023. Even in the face of rampant inflation, Rimes anticipates the gases and welding industry will see a positive year in 2023.

Nathan Stringer, President

B&R Industrial Supply, Inc.

An increase in inventory and additional suppliers will help B&R Industrial Supply, Inc. realize a 10-15% growth in 2023, even as supply chain issues persist. President Nathan Stringer anticipates that manufacturing will help the company realize that potential. “We feel that all industry will be up in 2023,” Stringer says. He notes that B&R added a new location in November 2022 and that sales will increase over the course of the year this year. Overall, this will be a year of growth for the gases and welding industry.

Revell Supply Group

Revell Supply Group anticipates a small growth of 3% in 2023, even as the company anticipates the overall industry to be down. “A few customers will have big jobs next year, otherwise I believe we would be down slightly,” the company says. The company’s biggest industries are construction and light industry, which it believes will be softening or down in 2023. It does plan for new product launches and an additional outside salesperson, “in a market that we currently serve but do not solicit,” both of which will be long-term growth drivers for Revell. The company has also expanded its safety categories and added in-house customization of safety gear in recent years.

Larry Simpson, President

Welders Supply & Gases of Louisville

A combination of price increase pass throughs and new revenue generated from organic growth and new logos will lead to a 6.5% growth in 2023 for Welders Supply & Gases of Louisville. The company is celebrating its 75th anniversary this year and has plans to launch a new 43,000 sq. ft. fill plant, according to President Larry Simpson. Through COVID, Welders Supply began offering multi-channel options for customers to continue to do business with them, including e-commerce and online chats, in addition to its phone and in-person service. “Our newest technology and automation have provided quality and efficiency controls and given us more control over our supply and deliveries,” says Simpson.

West

Coming off a year where it was the second most optimistic region in the country in 2022, combining to forecast 9.5% growth, the West continues to exude confidence in 2023. GAWDA members in the Western Region forecast a cumulative 7.1% growth in 2023.

Benjamin Bisconer, CEO

Complete Welders Supply

Complete Welders Supply anticipates growth of 5-8% in 2023, assuming a stable availability of bulk gases, according to CEO Benjamin Bisconer. “The continual shortages of CO2 in our region have been disruptive and are expected to continue through 2023,” he says. “In California, the state’s policies against the oil industry and manufacturing in general will continue to create challenges for us.” Still, the company has positioned itself in a way that it relies less on distribution from its manufacturers and has been able to bring that capability in-house, which has helped promote growth even in a projected level year for the industry.

Dave Burnett, President

DJB Gas Services, Inc.

“Uncertainty of the economy, labor shortages, and energy prices,” are three of the factors that continue to impact the economy in 2023, according to DJB Gas Services, Inc. President Dave Burnett. Still, the company anticipates 3-5% growth in the new year. Burnett feels that the Western region of the country should fare better than the rest of the country during an anticipated slowdown. That slowdown leads Burnett to predict a level year for the industry this year.

Stacy Lewis Hayes, CEO

Vern Lewis Welding Supply, Inc.

An uncertain economy combined with continued inflation leads Vern Lewis Welding Supply, Inc. CEO Stacy Lewis Hayes to project mild 1-3% growth for 2023. This is in line with her expectations of a level year for the industry as a whole. Supply Chain issues that have cropped up post-COVID will continue throughout the year, continuing to temper any growth opportunities that might exist.

Joshua Blas, Sales Manager

California Tool & Welding Supply

California Tool & Welding Supply will see an increase in sales in 2023, thanks primarily to steps it has taken to provide its customers with a strong online presence, says Sales Manager Joshua Blas. As others have noted, the CO2 market continues to be an issue. CTWS recently entered the Bulk CO2 market. CO2 won’t be the only gas supply issue posing problems in 2023, according to Blas. Helium, argon and CO2 all are difficult and expensive to procure and will impact the industry in 2023 if they persist all year.

2023 Supplier Business Forecast

Jump to top

By Steve Guglielmo

The following are responses from GAWDA suppliers across North America about what they expect to see in 2023. Many experienced a return to normalcy in 2022, though several commonalities emerged including: a skilled labor shortage, supply chain issues, and inflationary pressures. While those problems will remain throughout 2023, the overall consensus among GAWDA suppliers is that this will be a year of growth, although not the robust growth we saw pre-COVID. We thank all of the GAWDA suppliers who participated in this year’s forecast. Be sure to check out the GAWDA Online Buyer’s Guide (buyersguide.gawdamedia.com) to see individual company responses.

Hector Villarreal, President

Weldcoa

Weldcoa President Hector Villarreal anticipates seeing 10% growth or greater in 2023, even in the face of the persistent headwinds of a tight labor market. “The demand exists. Based on the amount of quotes we are generating, demand continues to increase,” he says. “For us, the capabilities exist. Lack of manpower is the issue.” The company is industry-renowned for its constant product development and improvement, something that Villarreal attributes to its client-driven process. “Weldcoa’s R&D is a little different than most companies,” he notes. “Our clients drive our product development process. They contact us with their issues, and they ask us for a solution. As such, we are constantly in a state of new product development.” With that in mind, 2023 projects to be a strong year for both Weldcoa and the industry.

Frank Salvucci, President

Anthony Welded Products

“Anthony Welded Products will press further into areas of the cylinder handling/storage space that we have not pursued aggressively in the past,” says President Frank Salvucci. “We look to grow our cradles, cages and pallets sales to complement our cylinder carts, led by our legacy model, the load-n-roll series.” This will help lead the company to an expected 10-15% growth in 2023. “These offerings are in response to the growing efficiency trend of distributors using the pallets throughout their fill plant and delivery processes to handle 12-15 cylinders at a time,” Salvucci says. “The cages, especially the ones with the pallet on the bottom, go along with the same palletization infrastructure that we are seeing an upward trend toward. We are actively listening to our customers and meeting their needs even if it is a custom order. We have the engineers and processes to be flexible with our products to meet the needs of distributors and their end user customers. Another initiative for 2023 is to continue the expansion of our Texas plant to increase capacity and efficiency including automation lines for our cradles, cages, and pallets.”

Tim Fusco, CEO

Trackabout, a Datacor Company

Trackabout, a Datacor Company, will parlay expansion with its existing customers and acquisition of new customers into a projected 17% growth in 2023, according to CEO Tim Fusco. “New business software is a big opportunity for gas distributors,” says Fusco. “This is a key way to get more efficient with all of the assets of the business. It is a key way to learn to do more with less over time.” Fusco says that Trackabout will “Continue to work with Datacor ERP to bring a new option for business software to gas distributors. By bringing together best-of-breed software systems for managing a gas & welding supply business, Datacor is working to raise the bar for software for gas distributors.”

Bob Ranc, National Sales Manager

MK Products

Bob Ranc, National Sales Manager for MK Products, projects a 5-6% increase in sales over 2022. “We expect the first half of the year to be good with a slowing as we head into the second half,” Ranc says. MK has plans to introduce new products in 2023, which will contribute to that projected growth and expand MK’s breadth of products. In addition to an increase in sales for MK Products, Ranc projects the industry to see a rise next year as well. “We look forward to working more closely with GAWDA distributors on our products,” he says. Of course, the best laid plans can all go awry depending on the political climate. Ranc concludes, “Can Washington get it together and do the right things?”

Jim Johnston, Executive Vice President

Kaplan Industries, Inc.

Kaplan Industries, Inc. anticipates a 5% growth in 2023, according to Executive Vice President Jim Johnston. “We anticipate business to be up over 2022 levels for the gas and welding industry,” Johnston says. “From industry forecasts, feedback from our customer base, and continued strong back log, we remain positive that 2023 will show growth.” He continues, “For our distributors, we see reduced lead times in 2023 and some stabilization of costs improving opportunities for them to capture new business in 2023. With that being said, the political and financial climate in the U.S. is fragile, a possible recession could take the wind out of all our sails.” This year, Kaplan Industries will continue to improve areas that haven’t been cost-effective including by implementing automated linear production to increase throughput and reduce in-house lead time. The company will continue to expand its fast-growing Hydrocarbon business for the cannabis industry, with increased bulk storage capacity and improved filling times. And one of its most important initiatives will be to continue to cultivate a positive work environment to maintain an efficient workforce during a time when maintaining employees has been a challenge for all businesses.

Anna Clark, Sales Director

Anova

“Anova remote monitoring solutions are increasing in demand from GAWDA distributors,” says Sales Director Anna Clark. “Distributors are realizing the increased profits and business efficiencies Anova remote monitoring creates for optimal scheduling, meaningful data analytics, and insightful reporting.” The company expects to see sales increase in 2023. “Data has immense value,” Clark says. “Distributors are already realizing the significance in digitizing assets for optimal business performance and increased profits. Remote asset management in the industrial world will increase in the coming years as distributors realize more and more gains from remote tank telemetry. Technology is leading the way for better business. Data has value and Anova provides the tools required to use that data to increase profits, boost customer satisfaction and reduce carbon emissions.” She concludes, “Our remote tank telemetry software and best-in-class customer service provides seamless asset management for the client and end-consumer. Our goal is to make sure customers gain as much value possible out of their existing data to increase profits, enable easier business operations and ensure happier end-consumers.”

Michael Veite, President

Veite Cryogenic Equipment and Service

Continued fallout from COVID leads Veite Cryogenic Equipment and Service President Michael Veite to project a level year, both for VCE and the industry. “It’s so hard to predict,” Veite says. “Everybody is still dealing with the fallout. The inability to get product on-time and prices skyrocketing has made it hard to project where the economy is going.” Still, Veite sees opportunities on the horizon. “As distributors continue to open satellite stores and fill plants, we see lots of opportunities there. That’s our A game and we are well-positioned to work with our customers on these new plants.”

Frank Heenan, Group Vice President Distribution and LBM

Epicor

“In 2023, we anticipate seeing double-digit growth for Epicor’s Distribution group – which will be a combination of new business, but also activity within the existing customer base,” says Frank Heenan, Group Vice President, Distribution and LBM, Epicor. “This will be impacted by a number of drivers. If the economy slows, distribution companies typically use the time to look at internal processes and seek improvements in efficiency. With current staff shortages, they’ll also look for opportunities to simplify and automate processes. We’re seeing more and more distributors moving to the cloud in an effort to reduce the IT burden and sure up security concerns they may have with their technology footprint or environment. These trends bode well for Epicor, as our ERP solutions are proven to help distributors increase efficiency, productivity, and revenue. Moving forward, we expect a few factors to play a role in the economic forecast for distributors in 2023: fluctuating fuel prices from the ongoing events in Ukraine, continuing challenges within the post-covid supply chain, and the evolving political landscape in the U.S. as an election year approaches. We encourage distributors to be introspective this year. Define areas for improvement. Look at your supply chain and operations – identify where you can be more efficient, automate, reduce error, and increase security. Use this year to uncover and implement internal opportunities to enhance your bottom line.”

John Kaylor, President

Abicor Binzel USA

New product launches and market share gains in 2023 will lead to an increase in sales above 5% for Abicor Binzel USA, according to President John Kaylor, even in an expected level year for the gases and welding industry. Kaylor predicts that while price pressures have lessened from the 2021-22 period, they will continue to be an issue this year and that GAWDA distributors should be aware of and prepare for them. He notes that Abicor Binzel will be making “large investments in U.S. production expansion to minimize global supply challenges.”

Rafael Arvelo, General Manager

EQUIGAS, Inc.

EQUIGAS, Inc. expects to see robust growth of more than 15% in 2023, says General Manager Rafael Arvelo. “Even though we are technically in a recession, we still have a solid economy, unemployment is still below 4% and reshoring projects will not slow down,” Arvelo says. “Production needs to move back to the U.S. ASAP. In 2022 alone, reshoring added 350,000 employees to U.S. soil.” This will be an exciting year for EQUIGAS, as the company looks to move into a larger building in North Carolina and open new locations in the U.S. Arvelo also notes that EQUIGAS will be launching two new brands that will benefit mostly independents. He concludes, “I understand that the forecast for 2023 and 2024 may not be pretty. However, I deeply believe that our industry will still have some growth. Trust your instincts, be ready, and don’t believe everything you hear in the news.”

Paul Kinsella, President

Exocor Filler Metals

Exocor Filler Metals President Paul Kinsella expects to see growth for the company in 2023, even as he anticipates the overall industry to see a dip. “After much better than market growth in 2022, we feel that our pace will moderate this year and finish higher by 7-9%,” he says. “Recessionary pressures will offset some of our market share increases.” Exocor expanded its U.S. headquarters and warehouse in January and continues to actively expand its geographical reach to a greater share of the U.S. market, complementing its sales presence throughout Canada. Kinsella adds, “We continue to add new products and the re-introduction of our welder friendly Non-Copper Coated 70S6 wire, with much less in the line of fumes and spatter, is the future for a healthier and cleaner manufacturing environment.” He concludes, “Supply issues will still be front and center in 2023 and driven by the same global turbulence that could be causing headwinds on business growth. Dramatically increased energy prices, brought about by both natural causes and man-made decisions, negatively impacting all aspects of supply and pricing and disruptions in production in various geographies that are critical for production of some commodities is not just possible, but a given.”

David Ellis, Vice President, Sales & Business Development, Compressed Gas Division

Cavagna North America

Cavagna North America expects a slowdown in the second half of 2023, according to Vice President, Sales & Business Development, Compressed Gas Division, David Ellis. That dip can be attributed to the overall inflationary environment, as well as the global increase in energy prices. Says Ellis, “All growth for 2023 is planned by introducing new products. Cavagna has launched a complete range of compressed gas regulators for the cutting and welding space. Additionally, we have introduced a smart meter for the propane market that will allow gas suppliers to manage customers and gas storage with IOT. As the medical market continues to move to smart technology, our digital Valve and Integrated Regulator for oxygen offers real time information to the medical professional.” Ellis also offers sage advice for GAWDA Distributors. “Protecting supply chain continuity is a lesson we all learned. Form alliances with suppliers so that your company is assured of uninterrupted supply of critically important raw materials,” he says. He concludes by saying, “Energy will continue to challenge everyone. Transportation costs due to the high cost of diesel continue to affect prices across all businesses. Any protracted strike in the rail industry would have a demonstrable effect on the entire economy.”

Kurt Tarkany, National Sales Manager

SuperFlash Compressed Gas Equipment

“Our business has been getting stronger each year as our partnerships with new and existing customers continue to grow,” says SuperFlash Compressed Gas Equipment National Sales Manager Kurt Tarkany. “We believe that the hangover effects from COVID will be further in the rearview mirror making the outlook incredibly positive for 2023.” Those factors will contribute to an expected 15% increase in sales for SuperFlash this year. “GAWDA distributors have worked hard to navigate through the difficult landscape of the past couple of years, and we have seen how so many of them are coming out on the other side stronger than ever before,” Tarkany notes. It is an exciting time for SuperFlash as the company has “added a line of mobile gas analyzers for Modified Atmospheric Packaging. Combined with our line of gas mixers, these products are ideal for the food packaging customers that use distributors’ gases for food packaging manufacturing. We also are breaking ground on a new location in the Phoenix area that will increase our footprint out west to go along with our locations in Florida and Ohio.”

Jeff Holyoak, VP Sales & Strategic Development

TOMCO Systems

“CO2 shortage aversion for the year will constrain recovery and efficient use of CO2 for the year, thus big capture and reuse projects may be another year out,” says Jeff Holyoak, VP Sales & Strategic Development, TOMCO Systems. “With CO2 in solid supply I think we’ll see some of the market rebound, specifically in dry ice. But large capital projects and potential for cutback in other industries will depress bulk storage demand.” Overall, Holyoak expects a 10% growth for TOMCO Systems and a level year for the industry. “Cannabis and grow houses will continue to grow,” he notes. “Increased usage and application of CO2 will improve opportunities. CO2 shortages won’t be as bad as 2022, but when they hit in Q3 there will be a quick reminder of how impactful they are.” He concludes, “We will continue to expand our CO2 capture and recovery business to ensure increased supply of CO2, greater green initiatives, and enable customers to take advantage of 45Q. Additionally we’ll see some new innovations in dry ice production as that market continues to expand.”

Matt Boettner, President and CEO

All Safe Global

Matt Boettner, President and CEO of All Safe Global, expects to see a sales increase of more than 7% in 2023. That growth will be driven in large part by continued spending in industrial infrastructure and growth in welding applications. He expects the industry overall to see growth as well, but notes that it will be “at slower growth rates than 2022.” This year, All Safe Global plans to invest in additional space for its cylinder requalification centers to expand capacity in the Midwest, Southwest, and to establish a presence in the eastern U.S. He concludes by saying, “Overall slowing of consumer spending in the second half of 2023 may lead to less consumer driven gas consumption such as Beverage CO2.”

Lexi McDermott, Welding Sales Specialist

Dynabrade, Inc.

2023 projects to be a strong year for Dynabrade, Inc. according to Welding Sales Specialist Lexi McDermott. “Dynabrade anticipates close to 20% growth in the welding channel, and an average growth of 10-15% across all other industries we sell into,” she says. As others have noted, supply chain continues to be a challenge. “We have continued to see a growth in our incoming orders over 2022. We are assembling and shipping products as soon as the parts arrive but are at the mercy of the supply chain to be able to support the increased demand,” McDermott says. “We have taken steps to diminish the delay by acquiring our largest parts supplier and increasing the number of parts manufactured there. We have goals to acquire other companies to further our market growth.” Dynabrade is constantly working on and releasing new tools and tool configurations to improve its product offerings. McDermott says that 2023 will be no different, as Dynabrade will have numerous new products ready to launch this year.

Tom Kairys, VP of Sales and Marketing

CP Industries

“I expect sales to be up due to independent distributors looking at ways to be self-sufficient in storing and transporting helium and hydrogen,” says CP Industries VP of Sales and Marketing Tom Kairys. That will help contribute to a projected 15-20% growth for CP Industries in 2023. Other factors contributing to that growth will be the continued emergence of alternative fuels for vehicles and the infrastructure that will be needed to achieve carbon neutral goals. “We are looking at some new developments and possible upgrades to our facility,” Kairys says of the company’s plans for 2023. He concludes, “The biggest opportunity that I see for the independents would be that the majors are focusing on the larger bulk accounts and neglecting the small to medium sized customers that are using bulk gases or could be prospects to use bulk gases with the right kind of mode change. Disruptors would include continued consolidation and acquisition of distributors and the emergence of new players in gas manufacturing.”

Tony Robbins, National Account Manager

Thunderbird Cylinders

Post-COVID, medical cylinder demand has decreased, leading Thunderbird Cylinders to project a decrease in sales in 2023. Says National Account Manager Tony Robbins, “Most companies have warehouses that are full of cylinders. These inventories will need to be reduced before you see orders begin to pick back up to pre-COVID levels.” This is an industry-wide issue, leading Robbins to project a down-year industry wide. Thunderbird continues to eye growth opportunities, either in “new customer/product development or through acquisitions,” says Robbins.

Chris Finn, Director of Sales

FINNCO Vaporizers

A long backlog combined with strong sales projections lead FINNCO Vaporizers Director of Sales Chris Finn to project an up-year in 2023. The company will debut a new location for manufacturing this year, which will also help contribute to a strong year. Finn notes that in addition to a growth year for FINNCO, “all indications are that sales will be up” for the gases and welding industry in 2023.

Matt Cable, President

BUG-O Systems

Though inflation, interest rates, and labor shortages will continue to be an issue in 2023 and beyond, BUG-O Systems still anticipates a growth of 5% in 2023. President Matt Cable notes that these challenges “will drive more manufacturers and fabricators to look for new methods to mechanize and automate their welding processes.” Even with those headwinds, Cable still sees an overall year of growth for the gases and welding industry.

Jack Walters, III, President

American Torch Tip

American Torch Tip President Jack Walters III projects an increase in sales in 2023. He notes that there is still a manufacturing backlog, which will help contribute to that growth. However, he cautions that, “We still believe there are ongoing supply chain issues in the market. Also, all of the CAPEX purchases are still behind in delivery.” However, he notes that, “ATTC offers advantages if you are trying to keep old equipment running or want to improve efficiencies in new builds of equipment.” Walters lists the three biggest opportunities that he feels GAWDA distributors should be aware of in 2023 as: automation and accessories, how to improve supply chain, and offering customers way to improve costs and efficiencies. He concludes, “Product development is an ongoing push for ATTC to grow our business. International competition is important for all U.S.-based manufacturers. Coming up with ways to decrease costs all while improving efficiencies is critical to win these competitions. One of ATTC’s main objectives is to help solve these challenges.”

Mike Arcieri, Vice President of Sales

Weldship Corporation

Weldship Corporation anticipates a 10% growth in 2023, according to Vice President of Sales Mike Arcieri. “We expect sales to be up this year as we continue to see the demand for gases worldwide stay high. We anticipate the high demand and have positioned ourselves to meet customer needs,” he says. As others have noted, supply chain issues will continue to impact the market in 2023. “As we continue to move away from the impact of COVID-19, we remain in a period of uncertainties for global shipping delays. We look at the trends within the industry and make decisions which we believe foresee the future needs of customers by preparing orders in advance, rather than reacting to inquiries as they come in. As companies are adapting to supply chain delays around the globe, we advise customers to focus on their equipment needs in the future and place orders well in advance of the date they will be needed on site. By planning ahead, we are given the adequate time to find and offer fleet tube trailers or build newly manufactured trailers.” He concludes, “We are always looking to expand our business through new product lines or growth in location. As we continue to manufacture the highest demanded equipment in tube trailers, ASME ground storage, and ISO containers, we stay current on the industry advancements and will continue to expand our product line with new ideas and designs. We are prepared for another strong year in 2023. We have done our best to adapt to the growing challenges that have emerged from the backlash of COVID-19 and feel that we have positioned ourselves to meet the demand of high-pressure gas storage.”

Michael R. Hopsicker, CEO

Ray Murray, Inc.

Ray Murray, Inc. will see a projected growth of 3-5% in 2023 based on the impact of its new products and entering a new market segment. CEO Michael R. Hopsicker and Compressed Gas Equipment Product Manager Mark Jenny expect to see the overall gases and welding industry be level for the year. “Some experts are predicting copper to be up 40% next year and as much as 100% in the next two years,” Hopsicker and Jenny say. Ray Murray plans to add new products in a couple of its market segments, as well as target new market segments this year. And while the company expects a strong year in 2023, it cautions that “the political push toward decarbonization could have a big impact on the industry over time. Clean energy sources like renewable propane and renewable natural gas are being unfairly banned in several states. This needs to change. We all want a cleaner planet but banning all fossil fuels is not the answer.”

Michael Tipper, President

US Tank & Cryogenic Equipment

Michael Tipper, President of US Tank & Cryogenic Equipment Inc. forecasts a growth of 15% in 2023, even as the headwinds of the labor shortage and supply chain issues continue. That growth will be driven, in part, due to a new offering of telemetry monitoring systems that US Tank has launched in conjunction with Otodata Telemetry. This new offering allows US Tank & Cryogenics’ customers to monitor PSI and liquid level with real time data and determine peak usage, including hours in use and volume. Tipper expects that to be a growth driver for the company in 2023. And though he expects the industry to increase this year, Tipper does fear a soft overall economy in 2023. Still, even with a difficult consumer economy in 2023, this year projects to be another strong one for US Tank & Cryogenic Equipment.

Kurt Johannes, Director of Industrial Distribution

Norton – Saint Gobain Abrasives

Kurt Johannes, Director of Industrial Distribution for Norton – Saint Gobain Abrasives anticipates growth in 2023, even as he expects the overall industry to be level. He notes, “Production levels are trending down, toward a recession. But pricing is helping for sales reporting.” Johannes does caution that additional pressure to the oil and gas industry could negatively impact the industry in 2023. And though the overall consumer economy may be heading for a recession this year, planned new product launches for Norton – Saint Gobain in 2023 will help buoy the company.

Sal Calandra, President

B&R Compliance Associates

B&R Compliance Associates has spent the last year adding many industry experts to its company “who expand our skill sets and complement each other very well,” says President Sal Calandra. Those new additions to the company will lead B&R to a significant increase in business for 2023. Says Calandra, “Many distributors are developing and growing bulk gases in addition to focusing on growing and de-risking their traditional base business. Like us, they are very customer-focused, which makes them attractive business partners.” One new offering that will help B&R realize that projected growth is a learning management system that will make training and development readily available to distributors and other industries. “We are also willing to find experts with additional expertise to support distributors,” Calandra says. B&R Compliance Associates currently has experts with skillsets covering FDA Food and Medical Compliance, Risk Management, Process Safety and Efficiency, DOT, Quality Systems and Certifications, Code Compliance, Validation, Food and Beverage Gases, Healthcare Installation training, OSHA – PSM & RMP, Food Safety, Food Science, and more.

Justin Guitreau, Executive Vice President

Tekno Valves North America

Growth in emerging markets like specialty gases and hydrogen will help Tekno Valves North America realize a projected 25-30% increase in 2023. Executive Vice President Justin Guitreau projects the industry to be up but with a caveat. “I believe it is all about the direction that a gas distributor takes,” he says. “If you continue to stay in the same markets that have dominated the last 15-20 years, I believe it will be an overall flat to slightly negative year. If you adjust your business to the emerging markets, I believe it would provide an immediate positive return.” In 2023, Tekno Valves North America plans to add additional regional salespeople to make in-person calls to its customer base. “We feel that in-person meetings are still the best way to do business, and the best way to truly understand a customer’s needs,” Guitreau says. Though he remains optimistic for a positive year, he points to disruptors like rising costs, raw material shortages, shipping increases and workforce compensation as things that could hinder growth. “GAWDA distributors must take note of this and see that they are justified in price increases to their customers,” he concludes.

Dave Eckert, Vice President of Industrial Markets

Industrial Pro, a division of Forney Industries

Dave Eckert, Vice President of Industrial Markets for Industrial Pro, a division of Forney Industries, anticipates more than 30% growth in sales in 2023. “Organic growth for hardgoods will be much harder to produce based on our view of the market,” Eckert says. “Many have relied on price increases to drive growth, especially to enhance the bottom-line. Our emphasis will be market share growth ensuring that our distributor partners maximize their sales by having the right offering to address their customer’s store-by-store. Ensuring that the end user does not go elsewhere for a solution our distributor partners should have available at an attractive margin.” He continues, “Our future is very focused and we continue to execute a three-tier strategy in our core products along with a supporting portfolio of key accessories and consumables for the welding distributor channel. At FABTECH, we introduced six new products to fill gaps and provide upgrades to our existing program, plus delivering true innovation consistent with our value proposition. Forney Pro, Forney and Easy Weld provide our distributor partners with solutions to match to their store needs.” He concludes, “We continue to execute our value proposition by delivering growth opportunities with products not adequately served by the big brands and generating margins uncharacteristic of the machine product category.”

Art Anderson, Managing Principal

AH Anderson Consulting, LLC

Art Anderson, Managing Principal at AH Anderson Consulting LLC, predicts a level year for both the company and the industry in 2023. He points to factors such as lingering inflation of supply chain and production costs, the possibility of a recession, reduced industrial manufacturing production, and flat-to-low single-digit growth in consumer spending as factors that will hold back robust growth in the new year. He also expects to see continued challenges with product availability across our industry’s product portfolio, including, but not limited to, helium, CO2, select spec gases, Argon, and others as challenges that will continue in 2023.

Western Sales and Testing, Inc.

2023 projects to be a level year for Western Sales and Testing, Inc., as supply chain challenges continue to impact the industry. Those challenges will impact the entire industry, as the company anticipates a level year for the gases and welding segment. However, even in the face of continued supply challenges, the company plans to expand in 2023.

Hardface Technologies by Postle

Hardface Technologies by Postle Industries expects to see a 10% growth in 2023. The company notes that while agriculture markets were flat in 2022, they are expected to see an increase in 2023. The company warns though, that continued high energy prices and a very tight labor market could negatively impact these projections and the industry this year. Still, there is optimism that the expansion that the company made in 2022 will be “full throttle” in 2023 and will lead to robust growth for the company. It notes, “if infrastructure expenditures by the state and federal governments continue to expand, we would expect growth in the cement and construction markets as well.”