Department of Labor Issues Final Rule Increasing Threshold for Overtime Exemption – The U.S. Department of Labor Wage and Hour Division has issued a final rule that will increase the threshold compensation amounts for employees to be exempt from requirements for overtime pay. The rule will go into effect July 1, 2024.

Employees are exempt from the Fair Labor Standards Act’s minimum wage and overtime protections if they are employed in a bona fide executive, administrative, or professional capacity, as those terms are defined in the Department’s regulations. To fall within the EAP exemption, an employee generally must meet three tests:

- be paid a salary, meaning that they are paid a predetermined and fixed amount that is not subject to reduction because of variations in the quality or quantity of work performed;

- be paid at least a specified weekly salary level; and

- primarily perform executive, administrative, or professional duties, as provided in the Department’s regulations.

The Department’s regulations also provide an alternative exemption test for certain highly compensated employees who are paid a salary, earn above a higher total annual compensation level, and satisfy a minimal duties test.

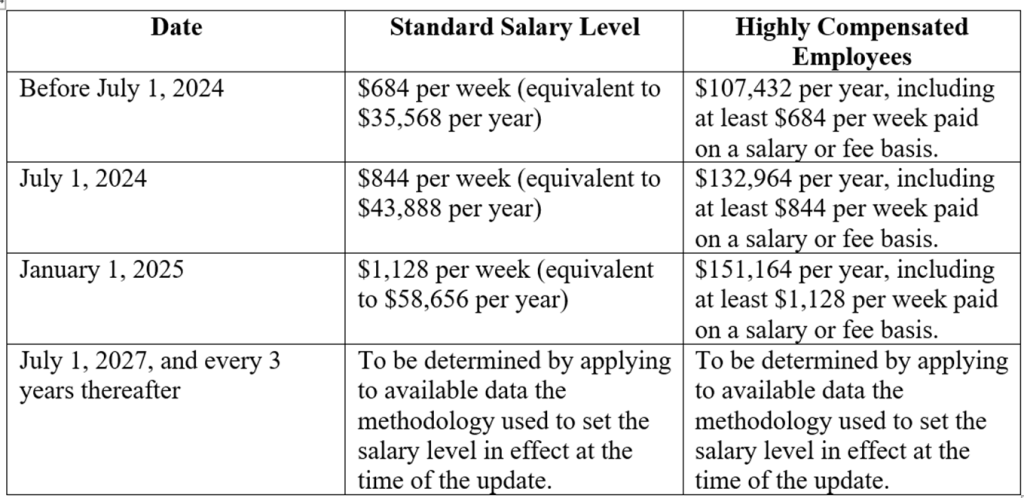

The final rule will increase the standard salary level and the highly compensated employee total annual compensation threshold on the rule’s effective date on July 1, 2024, and on January 1, 2025, when changes in the methodologies used to calculate these levels become applicable. The final rule also provides for future updates of these levels every three years beginning January 1, 2027 to reflect current earnings data. These scheduled increases are displayed below.

The final rule will increase the standard salary level and the highly compensated employee total annual compensation threshold on the rule’s effective date on July 1, 2024, and on January 1, 2025, when changes in the methodologies used to calculate these levels become applicable. The final rule also provides for future updates of these levels every three years to reflect current earnings data. These scheduled increases are displayed below.

Anyone in those employment categories making less than the threshold amount must be paid overtime of at least time and a half for all hours worked over 40 hours per week. The DOL estimates the final rule will affect over 3.6 million workers in the United States.

FTC Bans Non-Compete Agreements – In a 3-2 vote along partisan lines, the Federal Trade Commission adopted a final rule to ban new non-compete agreements for all workers as of the effective date of the rule, which will be 120 days after publication in the Federal Register. The rule will also ban enforcement of existing non-compete agreements in effect on the effective date of the rule for all workers except senior executives.

The rule applies to all employees and independent contractors but does not include franchisees in a franchise relationship. The rule exempts non-compete agreements as part of the sale of a business entity. Unlike the proposed rule, the final rule does not require a 25% ownership stake to exempt non-competes in a business sale.

A senior executive is defined as a worker who makes at least $151,164 per year and is in a policy making position. The term “policy making position” includes a business entity’s president, chief executive officer or the equivalent, any other officer of a business entity who has policy-making authority, or any other natural person who has policy-making authority for the business entity similar to an officer with policy-making authority.

The rule does not impose an outright ban on:

- non-disclosure agreements to protect a company’s proprietary information and trade secrets;

- non-recruitment provisions that prohibit a former worker from recruiting a company’s current employees;

- non-solicitation requirements barring a former worker from soliciting a company’s customers; or

- requirements to repay training costs if the worker did not complete an agreed period of work for the company.

But any of those terms might be considered an unfair method of competition and thus subject to the ban on non-compete agreements if they are so broad or punitive on the worker as to amount to a functional prohibition on competing with the company.

Companies that have non-compete agreements with workers must give notice to those workers that the agreement will not be enforceable after the effective date of the rule. The FTC has provided model language for such notice for the employers to use.

The FTC estimates that the rule will apply to over 101 million workers in the United States (California, North Dakota, Oklahoma and Minnesota already ban non-compete agreements) and will increase the compensation for affected workers by over $53 billion per year, or $524 per worker annually. In the final rule, the FTC noted GAWDA’s survey responses indicating that 80% of its member companies used non-compete agreements with at least some of their workers.

The U.S. Chamber of Commerce has stated it will challenge the rule in court, claiming that the Commission does not have specific authority from Congress to impose such a far-reaching requirement on American businesses.

A company that fails to abide by notice of violation of an FTC rule may be subject to civil penalties of up to $50,120 per violation.

For additional information please contact GAWDA General Counsel Rick Schweitzer at [email protected] or (202) 223-3040 or consult with your human resources counsel.