Despite calls for a slow first half of the year, GAWDA distributors look ahead to 2020 with confidence.

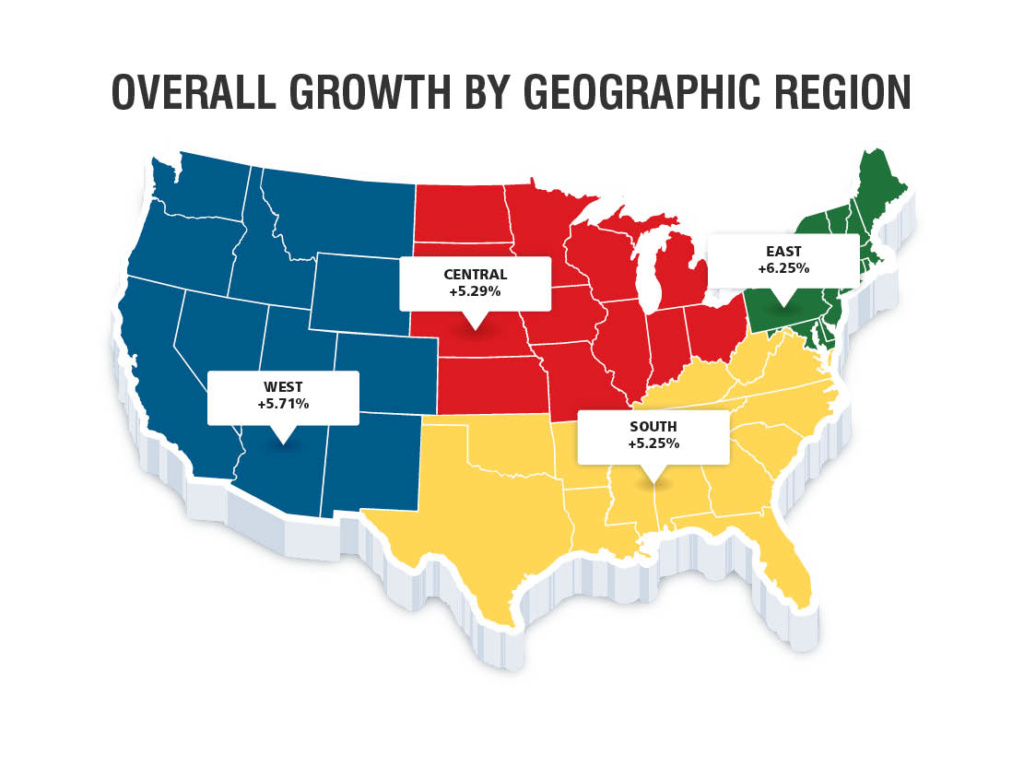

Each year in the 1st Quarter Issue of Welding & Gases Today, we survey the industry to try to determine what can be expected from the economy in the coming year. To do this, we have solicited not only distributor and supplier member expectations, but also spoke with the Chief GAWDA Economists at ITR Economics to hear their perspective (page 68.) These three perspectives, combined with the in-depth ITR Quarterly Report (page 72-83), all help paint a picture of what the economy has in store for the gases and welding industry this year. New this year, we have broken the distributor forecast down by region, as the economic climate is not uniform across the country and the industry.

Though the economy has seen a historic run of growth since the depths of the Great Recession, we have actually been experiencing a slight downturn in the second half of 2019 that is expected to extend into the first half of 2020, according to ITR Economics. However, off such a tremendous decade of success, even those companies who have forecasted a neutral or flat expectation for 2020 are basing that off of what was, in many cases, a record setting year in 2019.

The following are responses from GAWDA distributors across North America about what they expect to see in 2020. Thank you to those who participated.

East

The Eastern region of the United States is the most optimistic region of the country in 2020, predicting a cumulative 6.25% growth. It is also one of only two regions of the country that did not have a single forecast of decreasing or even level growth.

Lloyd Robinson, president of AWISCO, projects 2-3% growth for 2020. “The uncertainty with the tariffs along with the continuation of ‘trade wars’ is not helping grow the economy,” says Robinson. “I project that next year will be a somewhat difficult year with little to no growth.” In 2019, Robinson made an investment in automation that he expects to contribute to growth for the year. He also noted growth in the cryotherapy market. Though uncertainty of trade policy is dampening expectations, Robinson still predicts slight growth in 2020.

Liberty Supply, Inc. forecasts a growth of 5-7% in the New Year. Treasurer Pete Matarese is optimistic that the economy will remain strong in 2020. “If the economy remains strong, infrastructure needs rebuilding, which certainly helps our business,” he says. He notes that the corporate tax relief legislation passed in 2018 had an overall positive impact on business, but that it was not felt by Liberty. Specific markets that Matarese sees with growth potential include: infrastructure, roads and public transit. “These have recently had a significant impact on us,” he says.

2019 started poorly for Industrial Welding Supply, but President Jim Cusick saw an uptick toward the end of the year that he expects to carry into 2020. He forecasts a growth of 15% for the company in 2020. Like many other GAWDA distributors, he cautions that positive growth expectations could be hampered if the 2020 elections lead to more Democratic lawmakers. “We’re working on getting a new Bulk Contract and trying to get another equipment line,” says Cusick. “This will add to the bottom line.”

“We are constantly looking for new paths of growth, which include acquisition opportunities as well as working more with fellow independents,” says Jim Earlbeck, president of Earlbeck Gases & Technologies. Earlbeck notes that while growth is slowing from the last few years, he still anticipates a 4% growth in 2020. He notes that while customers have normalized to the political gamesmanship in Washington, D.C., an impeachment may put a wave out that the industry will find difficult to navigate. Short of that, however, Earlbeck predicts slightly positive growth for the overall industry. He also predicts that the trend toward consolidation will continue, but at a slower rate.

Echoing a sentiment expressed by many members, McKinney Welding Supply President Steven Mattiace says, “Political uncertainty continues to effect long-term planning.” He forecasts slow growth for the first quarter of the year. Similarly, he predicts neutral to slow positive growth for the industry at large. McKinney does not have plans to expand its lines of business or introduce new locations in 2020.

Churchtowne Gas expects a 5% sales increase in 2020, according to President Charles Mundt. This is roughly in line with Mundt’s projection of 2% growth for the industry at large, though he notes with 2020 being an election year it could “go either way.” One trend that Mundt has noticed is that propane prices have stayed lower in the cold weather, which has led to increased demand for Churchtowne. “We are considering adding employees if we can find the right experienced folks,” he says. One major change that he notes is that “Our costs to hire and keep drivers have grown by 20% in the last two years. We need to raise prices and/or add on charges to maintain margins.”

South

For 2020, the Southern region of the United States (and Caribbean) is the least optimistic region in the industry. However, it is by no means pessimistic, predicting an aggregate increase of 5.25%. Interestingly, though it has the lowest cumulative forecast, the South is the other region that had no predictions of negative or even neutral growth. Every respondent predicted positive growth for 2020.

“I’m optimistic,” says Southern Welders Supply Co. President Jan Fogle. “A lot of money has been spent by the major and intermediate players in our industry to expand. I see new competition in all aspects of our industry. I think it will be a conservative year as far as expansions are concerned.” Fogle notes that the uncertain political atmosphere has affected manufacturing most of all. “That greatly affects my business,” he says. “I think it has both grown and shrunk it. I expect this jaggedness to continue no matter what happens in the election. Manufacturing has been tumultuous due to China negotiations, both on a supply side and a customer side. I don’t know what to expect, but hopefully things grow more than they shrink.”

Larry Simpson, President of Welders Supply of Louisville, expects 4% growth in 2020, driven primarily by gas prices and an expanded product offering. Trends that he’s seen in 2019 that he expects to continue into 2020 and beyond include: big regional distributors continuing to grow/expand, customers in need of help identifying productivity improvements/savings, and talent acquisition/development as a key pivot point for supporting growth. “We will continue expanding product offerings that complement our traditional gas and welding business,” says Simpson. “We will look to expand wallet share in existing accounts and create new account opportunities.” Some growth markets that he’s identified are abrasives, first aid and safety, and beverage gases.

Interstate Welding Vice President Greg Bradshaw sees growth both for Interstate and the overall industry on the back of a great economy next year. He specifically points to steel sales as a reason for optimism for Interstate. “We do welding supply and we added steel sales years ago,” he says. “In our area, this works well together.” He notes that tariffs have had an impact and continue to increase but says, “Sales continue to rise.”

Empresas de Soldaduras General Manager Wigberto de la Cruz forecasts an increase in sales in 2020. “For our region (Puerto Rico and Virgin Islands) we project positive growth because a lot of new projects are coming in 2020,” he says. “Also, we are opening a new location for sales and a new expansion in our gas operation facilities.” He goes on to say, “Our advantage is that we are locals and our service is faster than competitors in our area. Prices are always a concern and because of our condition as an island, we have to pay more in shipping. Customers know about changes in prices in the market.” In addition to the new location and expanded gas operation facilities, de la Cruz says that the company is acquiring more space in one of its eight locations. “In the last ten years, our big growth has been in cylinders,” he says. “It’s a part of the business where we put a lot of effort and investment.”

Michael Crambes, VP of Operations at Pure Air Ltd., predicts 2-3% organic growth for the company over 2019. “We are in the southern U.S. and Caribbean. In the U.S. we are projecting positive 2-3% above 2019,” he says. “In the Caribbean, we are projecting 4-5% above 2019.” He notes that consolidation has been an ongoing trend but says, “In our opinion, consolidation helps a market and stabilizes prices. We see a slow down in consolidation for the next 2-3 years.” He also says that he doesn’t expect “measurable inflation” to hit until 2021, when he sees 3-4% inflation. The company has expansion plans in 2020, with a pending acquisition in North Texas. “We see an opportunity to become a regional player over the next few years,” says Crambes. “Secondary and rural markets service levels are being neglected and we see a niche opportunity when that occurs.”

Marvin Rodgers, III, President of Airco Gases and Big Three Gas and Supply, says the company is investing heavily in its people to communicate its message to the market, as well as in assets and operations. “We expect that sales for our acquisition in the DFW market will be up significantly in 2020 from their 2019 run rate,” he says. “Our entire business model is focused on expansion, primarily organic. We will be adding bulk distribution, medical and specialty gas sales and production, and expanding our technology offerings. We also expect to scratch start at least one new location in 2020. By expanding our offerings, and particularly by controlling more of our production and distribution capabilities, we expect that we will be able to leverage our willingness to differentiate ourselves by providing high levels of service to the customer without sacrificing profitability.” He adds, “We are glad to be back in and involved with such a dynamic and broad industry.”

CENTRAL

The Central Region of the country had the most respondents to this year’s survey. With forecasts ranging from a 5% contraction to a 15% growth, it was easily the most volatile region of the country. Overall, respondents forecasted a combined 5.29% growth for 2020.

Construction will drive an expected 5% increase for Central Ohio Welding in 2020, according to General Manager Brad Davis. “I would expect neutral growth for the industry as a whole. Our national economy is still healthy, but the factors that are driving it have changed in the last two years,” says Davis. “Whereas business investment was increasing in 2017-2019, it is now flat to slightly negative. Other types of spending have positive benefits, but not to the same extent.” He continues, “If the economy falters or goes into recession, I think we will see some large independent distributors purchased by majors in a similar way to what we have seen during other recessions. Steel prices were more of an issue during 2018-19 than they will be in 2020.” After being in the same set of buildings for more than 100 years, Central Ohio Welding will move into a newer and larger headquarters in 2020, complete with a new fill plant, showroom and administrative offices. The distributor will also open a new satellite branch, the first in its history. “These moves were driven primarily by the growth in our region and our faith in its future,” says Davis.

Weldstar Company also anticipates 5% organic growth in 2020. “We really have difficulty projecting overall growth due to various political uncertainties including trade agreements and an upcoming election,” says Weldstar President Matt Winkle. “Most economists we have heard are calling for very modest growth through 2020.” The company expects to launch a new location in the spring. It also completed a new state-of-the-art specialty gas lab, which Winkle expects to bring increased capabilities and new and non-traditional opportunities.

Josh Weinmann, President of Delille Oxygen Company, forecasts 10-15% growth in 2020. “I think overall growth will be slightly positive to neutral. I don’t believe it will be as good as 2019 was, but not as bad as the forecasts are predicting,” says Weinmann. “With interest rates so low and a strong stock market going into 2020, I think there will be some investments being made in various sectors, but political uncertainty and trade wars will limit that.” Weinmann says that Delille is expanding its business by doing a special project of on-site gas generation. “This will greatly help our overall growth in 2020 as well as future growth, and not just in revenue, but the experience of doing this project,” he says. “Whenever we have taken on new manufacturing projects, we make sure to utilize the lessons learned for future expansion.”

Hartman Brothers, Inc. President Kirk Hartman also expects 15% growth in 2020, on the back of bulk CO2 for CBD extraction. Hartman cautions that this projection could be negatively impacted by the election results in November. “Our company continues to grow and prosper, thanks to Trump,” he says. A growth market that Hartman is excited about is the coal business.

James C. Dawes Co. Inc. Owner Brian C. Dawes anticipates a flat 2020, with gas & oil construction down. That prediction applies to both James C. Dawes and the overall industry. The distributor is currently looking at property in West Virginia, across from a multi-billion dollar plant along the Ohio River. Dawes will pay special attention to the continued growth of the domestic gas and oil industry in the U.S., which he believes will have a positive impact on the economy going forward.

An election year with a robust economy will lead to a 6% growth for Indiana Oxygen in 2020, says CEO Wally Brant. “Online sales have been hit very hard by the Supreme Court reversal regarding sales tax,” says Brant. “The cost to comply with all the different state taxes is extremely time-consuming and expensive. Still, I believe online sales have stabilized permanently, proving the brick and mortar stores still have a prominent place in our industry.” Something Indiana Oxygen is focusing on is “bringing the online B2C business experience and convenience to existing B2B customers.” Assuming a business-friendly president and Congress are elected, Brant expects the economy to remain strong through 2020 and into 2021. However, he cautions that growth will continue to be restrained by the lack of qualified CDL drivers.

As process automation continues to increase, Mississippi Welders Supply Chairman Brad Peterson predicts a 5% growth in 2020. He anticipates that Mississippi Welders will continue to add key players to broaden its market penetration. “Automation has been very good for us,” he notes. “Customers can’t find employees, so they need to automate.” With so many uncertainties, Peterson expects a neutral year for the industry overall.

Paul Rensing, President of Weld Plus, Inc., anticipates 10% growth in 2020. “Experts say the first two quarters of 2020 will be slow,” says Rensing. “We had bad third and fourth quarter of 2019. We have so much work quoted and have heard customers say they plan to get this work done that I believe we will see a 10% to 15% increase from 2019.” While he notes that tariffs have slowed things down a bit, he believes that they will be relaxed a bit in 2020. The bigger international impact is that, “There are other places in the world that now have to compete with the U.S. straight up. That should give us an advantage on the world stage.” Weld Plus, Inc. has started a private label and Rensing says they will continue to expand that business.

O.E. Meyer Co. forecasts growth in the single digits over 2019. “I think our industry will continue to grow, but at a slower rate in 2020 than we’ve experienced the last few years,” says VP of Sales Eric Wood. “In 2019 the trends that impacted us the most were low scrap prices, low propane costs, and our struggle to employ and retain CDL personnel. We are beginning to see propane prices increase with the increase in demand, and we are taking a different approach to hiring, training, and the investment in our drivers.” Wood believes that growth in 2020 will come from growing market share by taking competitive business. “We continue to expand our automation capabilities and are expanding the geography of our beverage CO2 and residential propane business units.”

A loss of hard good sales leads Rodney Huber to project a 5% decrease in 2020. The President of Huber Supply Co., Inc. notes that the distributor is entering several new markets, “But we do not have plans to set up physical locations at this time. We plan to service from our existing footprint.” He notes that propane is a potential growth market for Huber. In a departure from what several other respondents have said, Huber does not believe that the political atmosphere or the looming presidential election have impacted sales or that they will in 2020.

A stable economy and continued capital investment spell a 5% growth for Purity Cylinder Gases, according to Sales Manager Scott Berg. He expects the overall industry to be slightly positive but with continued price pressure from suppliers and customers. Purity continues to build in two newer markets in 2020. That combined with a growth market in dry ice manufacture and dry ice blasting, keep Purity optimistic going into 2020, despite the price chaos driven in part by the tariffs.

“Everyone is spending money to rebuild,” says Thomas Budae, President of Flint Welding Supply. “Hopefully it being an election year doesn’t put a hold on a lot of proposed projects.” Budae projects level sales with 2019. He notes that the company is upgrading its liquid oxygen station, which will lead to lower costs. As many have noted, “The medical marijuana market in Michigan is booming right now. CO2 is a big seller,” says Budae.

WEST

The Western region of the country is the second most optimistic, according to this survey. Respondents predict a cumulative 5.71% growth in 2020.

Steve Cox, Harris Industrial Gases Sales Manager, expects the gas portion of the business to grow by 10%, while the hard goods side remains flat in 2020. He expressed optimism for continued growth and stronger margins, “As there will hopefully be some discipline back in the quoting process.” Cox notes that the national atmosphere is overall business-friendly, but that “California continues to drive our clients out of state. This is deleterious to our projections.” As many other respondents have noted, Cox says that the cannabis market “is and will continue to be flourishing.” Cox also says that Harris is seeking to become more independent, with plans to add a location and fill plant to lessen dependence on the majors.

Construction, Oil and Forestry Recovery will be the primary drivers of a 6-8% growth for Western Gasco Cylinders Ltd., according to President Stu Younger. Younger notes that he has seen the economy slow in the waning months of 2019, which leads to a neutral to slightly positive projection for the overall industry. “We’ve seen rising prices due to trade uncertainty, tariffs and steel prices,” says Younger. “Everyone has really increased prices, so we may have some retrenchment if the economy softens.” With a new minority government in Canada, Younger doesn’t expect a lot of changes to the Canadian economy. However, he says, “We expect 2020 for the U.S. to be full of uncertainty, just as 2019 was.”

DJB Gas Services President Dave Burnett forecasts 10-15% growth in 2020. “We’re planning some smaller acquisitions and a new major product line that should add growth in 2020,” says Burnett. For the economy as a whole, he predicts positive growth, albeit at a slower rate than 2019. He notes that the political atmosphere in Washington will have “no impact as long as there are no major governing changes.” He notes that in the event of a major governing change, growth could be negatively impacted in 2020. In terms of growth potential, he notes that CO2 and the life sciences markets continue to be growth markets.

Following a strong 2019 and a slow down in manufacturing, Glenn Bliss, president of General Distributing Co. predicts a 1% decrease in sales compared to 2019. Like many others, he notes that tariff uncertainty and a looming election year, combined with a slowdown in manufacturing in Q4 2019 that he believes may linger into 2020, have all had an impact on business. To counter a slowdown in sales, Bliss notes that possible new locations and territory and a new product line could be in the cards for the distributor next year. “Commercial and industrial customers are holding onto cash and holding off on capital investment,” says Bliss. “Election uncertainty seems to be a common theme and concern.” He also notes that a continued tight labor pool of qualified employees and challenges in the health care system are an ongoing concern.

Britt Wuest, President of Bishop Welding Supply, anticipates a level year for Bishop and a 3% growth for the industry in 2020. Wuest expects mild inflation of 1-2% in the upcoming year. Bishop has seen tariffs but has been able to pass those costs through. Growth markets for Bishop include carbon dioxide for breweries and cannabis extraction.

Norco Inc. CEO Jim Kissler anticipates 5-8% growth in 2020, with a similar projection for the industry. “We will be impacted by the national economy,” he says. Other impacts include manufacturing growth and a potential end to the trade war with international trading partners. “The Trump economy is charging ahead,” says Kissler. “Job growth is good and consumer confidence is holding up. Employees will continue to face competition for hiring good employees and general wage increases to retain staff.” To combat this, Norco initiated a minimum wage of almost double the Federal minimum. The distributor adds 2-3 new locations per year, through acquisition or start-ups. “We also remodel or build new stores aggressively,” Kissler says. “We currently have seven construction projects underway in the states we operate in. Our headcount is fairly stable, but we are adding executive positions to oversee the branch locations and ensure safety.” He adds, “The last 5 – 10 years have provided stable economic growth opportunities for most distributors. Investing in our businesses and facilities is the right thing to do while the economy is strong. Acquisitions will also be available to distributors with strong balance sheets. Look for small or medium distributors without viable succession plans.”

Though Vern Lewis Welding Supply CEO Stacy Lewis Hayes notes that the market is slowing, she still anticipates a 5% growth in 2020. Vern Lewis has plans to open a new location and expects to see returns quickly from that expansion. While Hayes notes the impact of tariffs, she feels that the new tax law has offset the impact. “We don’t feel the election will affect us much,” says Hayes. Hayes notes that “anything that moves forward technology-wise” is a niche/growth market in the industry, specifically pointing to plasma technology and robotics.