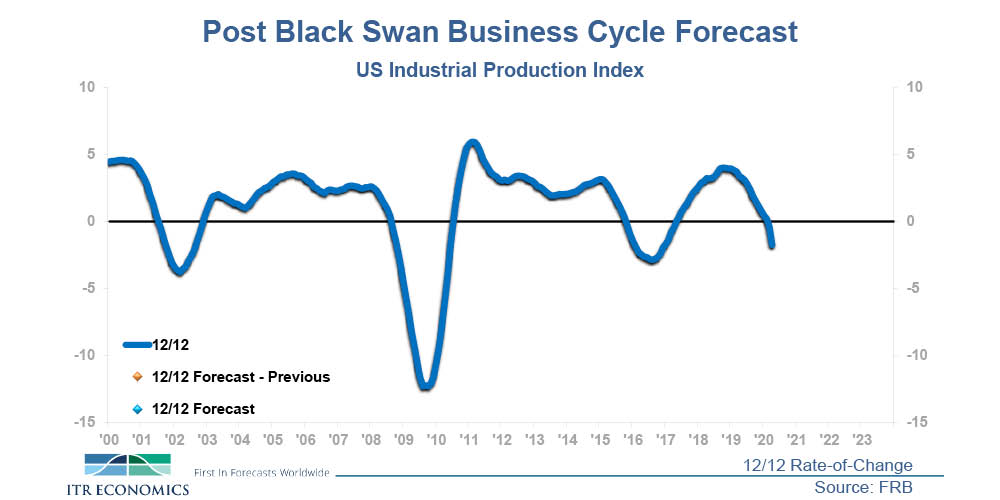

In times of economic turmoil, GAWDA members have long turned to the association’s Chief Economist Brian Beaulieu and his team at ITR Economics. ITR, which produces a quarterly report for GAWDA members each quarter (this quarter’s can be seen on pages 106-117), hosted a members-only podcast entitled Looking Past the Fear and The Noise: 2020-2022. Alex Chausovsky, ITR’s Director of Speaking Services, hosted the webinar, a recording of which can be found on GAWDA.org’s Member’s Only section in the ITR folder. Alex spent the hour-long recording explaining the impact that the “Dual Black Swan Events” of COVID-19 and the collapse of oil prices had on our economy and what the ITR expectations are for the coming year.

ITR has developed a well-deserved reputation as “straight shooters.” They predicted the Great Recession long before most other economists and did so with laser precision and brutal honesty. So, it should not be taken lightly that ITR has referred to the 2020s as “the decade of North America.” During the webinar, Chausovsky spent the first several minutes detailing the data surrounding COVID-19 test and mortality rates, as the pandemic has undeniably had a severe impact on the U.S. and global economy. He explained that there are encouraging signs in this trend and that there are signs of a negative trend in daily new confirmed deaths due to COVID-19, not just in the U.S., but worldwide.

Chausovsky also explained how, before the black swan events, the economy was actually showing signs of a rise.

“One of the things you will have noted if you follow the ITR leading indicators or GAWDA reports, if you look at the economic data before the black swan events in late 2019 or early 2020 is that all of our main leading indicators were pointing to a rise in the U.S. economy in the second half of 2020,” he noted. “Once the events of the first quarter, the rise in the pandemic and the oil price collapse, occurred, almost all of the leading indicators changed to declining trends. But we are now starting to see a turnaround.”

Though ITR expects a more volatile recovery than a straight line “V-shaped recovery,” he noted that, notwithstanding a second wave that forces the country back into a shutdown, the U.S. economy, especially the industrial economy, can expect to see that rise heading into and throughout 2021.

Brian Beaulieu, CEO of ITR Economics, echoed that sentiment.

“It’s not going to be nearly as devastating as a lot of people initially feared,” Beaulieu said. “We’ve had a demand issue to contend with, also. That helped level off a lot of the supply and demand imbalance that a lot of people were fearing. This creates opportunities for people who can think differently. Find out what your customers really want and how you can help them. There are opportunities in this, like any other circumstance.”

One of those opportunities stems from the supply chain disruption caused by the pandemic.

“We believe that, as part of the pandemic and as part of the disruption of the supply chains, there are quite a few opportunities out there that are going to be available to you as part of the supply chain near sourcing trend that we started building up on back in 2018 at the beginning of the trade war,” Chausovsky says. “We think that companies are going to be looking for gaps in their supply chains. New business formation will happen as companies try to fill those gaps, so you’ve got to be very proactive in terms of finding opportunities. Ask your existing clients whether they have any concrete plans addressing any potential vulnerabilities in their supply chain. At the same time, be looking for any new entrants into the industry that might be filling those gaps and try to convert them into customers as well.”

This sudden downturn is not unlike the Recession in 2008. Though not on the scale and not projecting to be the length, companies need to balance the immediate circumstances and the headwinds that they are currently facing with being positioned for the coming growth and upswing that are right around the corner.

“Make sure that you have reliable, understandable cash flow modeling for your business,” Beaulieu suggests. “What’s the cash going to be like coming in and the cash going out? Not just for the next six weeks, but into September. You need to know what you are confronted with, even after the PPP money runs out. Know your cash flow situation. Remember, when there is a recovery, and it is coming, that recoveries take cash.”

The recovery that ITR had projected for the back half of 2020 has now been pushed into 2021. ITR expects 2021 to be a year of recovery and business cycle rise, before giving way to the backside of the business cycle in 2022, which will still be a year of growth but slowing growth compared to 2021.

“A key take away that I want people to walk away from the webinar with is that you can’t lose track of the long-game despite the quagmire that we’ve found ourselves in today,” Chausovsky says. “There is nothing overtly scary in the next two to three years once we get past this current slow point.”

Finally, Chausovsky mentioned that it is important to look beyond your company’s current situation and get to know the financial situation of your key suppliers and customers.

“When you are trying to assess your own financial situation and how you are doing from a footing perspective, you’ve got to be taking the same approach not only to yourself but also to your clients and suppliers,” Chausovsky says. “Understand where their vulnerabilities are, especially from a client perspective, and if you’ve come to the conclusion that the client is on solid financial ground, be more open and willing to accept longer financial terms to get in more additional orders. Be more flexible with those clients. However, if you’re seeing that they are not financially viable, be more careful in how you tread with them.”

Chausovsky concluded the webinar on an encouraging note for attendees and the GAWDA membership at large, saying, “We believe that the 2020s will harken in a new bright spot of manufacturing in North America, whether that’s in the U.S., Canada or Mexico. This is a bright spot or silver lining to the downturn that we’re facing right now.”

For more information regarding ITR’s trend data, make sure to read the quarterly ITR Report that can be found on pages 106-117. ITR is also offering 90 days of free access to its trend report. To redeem this offer, text “TR OFFER” to 33777. This report will allow you to follow the leading indicators through this critical time, stay current on industrial and financial market trends and get ITR’s insights as important world events unfold.

Managing Your Future: ITR Management Objectives™

- Be sure your cash flow modeling is reliable

- Take advantage of various lending programs / lines of credit

- Know how your suppliers and customers are doing financially

- Focus on markets/customers based on recovery rates

- Develop your own rates of change; timing is everything Managing Your Future