GAWDA Distributors Forecast Gases & Welding Economy for 2025

Every year, the first quarter issue of Welding & Gases Today sets the tone for the coming year with the forecast issue. Not only do we speak with our distributor and supplier (page 58) members, but we also have our sister organizations like the American Welding Society (page 78) and Compressed Gas Association (page 80) contribute their thoughts on the upcoming year, to be combined with the quarterly ITR Economic Forecast (page 88). This issue also features the first look at this year’s Spring Management Conference, which will set the theme for GAWDA’s 80th Year, Sustaining a Resilient Culture.

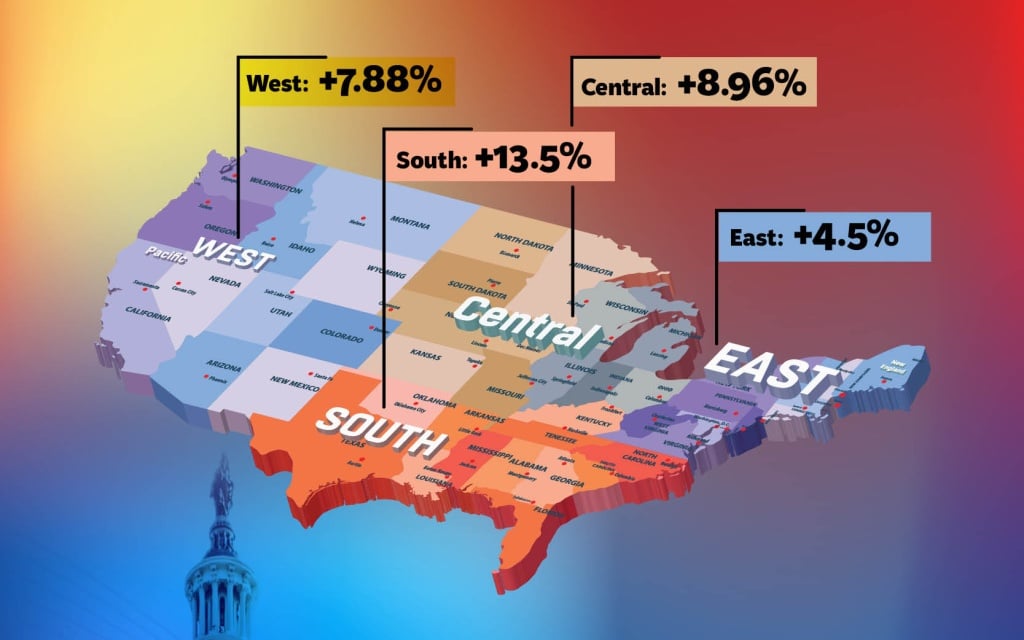

Last year, GAWDA members across the board were optimistic, yet hesitant, due to the looming prospect of the November elections. Now, with the elections in the rear-view mirror, members expect to see growth in 2025. They see some fallout from political factors like tariffs and resulting supply chain challenges, but overall expect 2025 to be a very pro-business environment. Surprisingly, though, the forecast numbers bear out very similar to the overall expectations for last year, even with the comments sounding more bullish and enthusiastic. The South remains the most optimistic region, projecting a cumulative 13.5% growth expectation vs. 13.63% in 2024. The East remains the least optimistic, with 4.5% growth forecasted vs. nearly 8% in 2024. And the Central and West Coast expectations were nearly in lock-step as well. An interesting dichotomy between the numbers and the rhetoric. But the overall message remains one of optimism for 2025, as respondents across regions and products lines universally preached growth and prosperity for 2025!

The following are responses from GAWDA Distributors broken down by geographic regions. Thank you to all who participated.

JUMP TO SECTION: EAST | SOUTH | CENTRAL | WEST

EAST

Perhaps no region is more emblematic of growth not being linear than the East region. In 2023, the Region projected the highest growth in the country, with a cumulative 9.43% growth. Last year, it projected 7.83% growth, and this year it is forecasting 4.5% growth.

Lloyd Robinson, President

Lowering interest rates and seeing the fruits of the infrastructure act will help propel AWISCO to a projected 3-5% growth in 2025, according to President Lloyd Robinson, even as he sees a flat year for the industry at large. In addition to those macro-level trends, the company also recently introduced an e-commerce site, which has helped drive sales. The company remains on the lookout for acquisition targets, “and I hope to land one or two in 2025,” Robinson concludes.

David Goldstein, Vice President of Finance

AGL Welding Supply projects growth of 4% in 2025, according to Vice President of Finance David Goldstein. The primary drivers of that 4% growth include hardgoods supply and pricing and the ability to source locally produced goods. The company continuously monitors and positions itself with its suppliers to ensure it can source product. He notes, “The new administration certainly will have both negative and positive impacts to all industries across the board. The largest impact to our industry clearly will be the cost of goods, whether imports or domestically produced. The political climate is extremally volatile, I believe this will cause significant disruption and at least a big distraction to staying focused on the goals of the business.” Finally, AGL has plans for an expansion in the near future to reach its customer base in other parts of New Jersey.

John Larsen, Vice President

“Sales, especially big-ticket items, were a little erratic last year. 2024 started and ended great with some down months in the middle. We are not sure if this was due to interest rates or the election, but we are optimistic for a more consistent 2025,” says West Penn Laco Vice President John Larsen, who projects 5-8% growth in 2025. The company continues to diversify its suppliers and are better at monitoring its inventory levels, according to Larsen. “While inventory is back to more traditional levels, we are better prepared for future disruptions.” He concludes, “Lower taxes and deregulation would be a positive for our business and our customers. However, new or increased tariffs will likely raise costs for us and our customers and create shortages.” West Penn Laco will continue to look at new products to offer its customers in 2025 while also investing in new technology to reach new customers and service existing customers better.

Alfred Boehm, President

2025 will be a year of growth, according to Specgas, Inc. President Alfred Boehm. “Given the economic situation, we expect to get more requests for specialty gas mixtures and noble gases. Increased drilling for oil and earth gas will require more calibration gases. Increased AI applications will impact the demand for domestic chip production, positively impacting electronic gases.” He concludes, “Given the focus on domestic production, we will see an increase in the entire gas business.”

South

In 2024, the South was, by far, the most optimistic region in the country, projecting 13.63% growth. While not quite reaching those heights again this year, the South once again projects as the highest growth region, projecting a cumulative 13.5% growth in 2025.

John Hill, President

Willard C. Starcher, Inc.

An increase in oil and gas drilling production will have an immediate positive impact on the bottom-line for Willard C. Starcher in 2025, according to President John Hill, who projects to see a 5% sales growth. He cautions that potential supply chain interruptions could hinder that number, however. Overall, Hill expects 2025 to be a year of growth, not only for Willard C. Starcher, but for the industry as a whole. “Drilling would drive up sales and cause a significant increase in the local employment figures,” he says. That, plus an increase in pipeline construction would be the two biggest benefits in an area that used to be dominated by coal-mining, which Hill does not expect to see a revival.

Mike Wallis, Owner

The overall trend toward mergers & acquisitions in recent years has left the industry with less true independents, a fact that will benefit Air Supply and, coupled with price increased in 2025, help contribute to a 5-10% growth for the company, according to Owner Mike Wallis. Wallis also sees a more pro-business environment this year, with less government interference than previous years. However, he cautions that the economy had been “in stagnation mode with lots of money being printed. When will that bubble pop?”

Rodney Wray, President

Meritus Gas Partners, North Texas

“Meritus acquired – and we are integrating – four different, very successful businesses in North Texas. By doing so, we have become a very strong, diverse regional player, perhaps the largest independent distributor in the area,” says Meritus North Texas President Rodney Wray, who projects growth for the company in 2025. “In Texas, the new administration will positively impact the oil and gas related markets for us. We have just come off a very strong year, and the future looks very promising in North Texas.” The company has plans for several scratch starts to open up in new geographies in addition to continuing to expand its bulk business in the region. “We also have a great Specialty Gas lab in Tyler, TX and we are focused on leveraging and expanding those capabilities.” In 2024, the company also added a bulk nitrogen transport, which was a boon for the business.

Heather Dehnz, Owner

Southern Service & Repair

While the new administration will have a positive impact on the overall business environment and will hopefully lead to lower taxes, Southern Service & Repair Owner Heather Dehnz cautions that it’s still an overall difficult environment in the industry right now. “Costs continue to rise,” Dehnz notes. “Both the costs of gas and supplies have gone up continuously. We just paid for a six-months force majeure on all gas products and we still have one on CO2. That’s unsustainable.” The company, which will celebrate its 20th anniversary in 2027, expects to see a level year for the industry in 2025.

Robby Smith, President

American Industrial Gases, LLC

2025 will be a year of robust growth for American Industrial Gases, LLC, according to President Robby Smith. The company will be expanding its product offerings and its geographic coverage with specialized product focus in the new year. In addition, the pro-business environment will be a rising tide that lifts all ships in the industry. There will be an “extremely positive impact, we’re already seeing it” says Smith about the new administration’s impact on the economy. “An ‘America First’ focus make me very optimistic,” he concludes.

Central

True to form, the Central was once again the region with the highest number of respondents to this year’s survey. This makes it the region least impacted by individual outliers. However, even with that, it still remains remarkably consistent. This year, it is the second most optimistic region, projecting 8.96% growth vs. last year’s 7.5% projection.

Tim Molenbeek, General Manager

Automotive industry as well as the recreation industry production (boats and RV’s) coming back online and capital spending increases will all be contributors to an anticipated increase in sales for Purity Cylinder Gases, Inc. in 2025 according to General Manager Tim Molenbeek. “Our best success comes from our salesforce on the streets, in front of customers, and continuing to out-service the competition,” Molenbeek says. He notes that welding automation continues to help with labor shortages and quality control in production, while the automotive industry should come back after pausing in 2024. He concludes that, following the election, onshoring, investments, and manufacturing should all see positive impacts, leading to an overall increase for the industry.

Eric Wood, COO

An increase in the production of vehicles with combustion engines, allocated government defense spending, and an expansion in current and new markets will be the biggest factors contributing to forecasted revenue increases in sales for O.E. Meyer in 2025, according to COO Eric Wood. “We added and continue to add specialized sales and technical service representatives to provide services and technical assistance that is unique in our markets,” Wood says. “With the recent election and from monies dedicated to infrastructure from the past administration, we are bullish on automotive, domestic steel production, and fossil fuel energy expansion.” Wood notes that O.E. Meyer continues to expand its sales and distribution into new markets by providing services and expanded offerings to its end-users and that it has recently entered two new markets, which continues to pay benefits.

Brad Davis, Vice President

“Our local economy is strong and seems to be getting stronger each year. Manufacturing has been slightly up, and new commercial and industrial construction has been surging,” says Central Ohio Welding Vice President Brad Davis. The company is forecasting growth of 8% in 2025. “We continue to look for customers that fit the specific value proposition that we can offer our regional market. We have learned that we cannot serve everyone, and have worked on refining our model to serve the customers where we fit.” Davis notes that, “Central Ohio is undergoing rapid changes and is currently dominated by large construction projects that are set to structurally change the local landscape in the future. Hi-tech industries like Semiconductors and Biotech are leading the change.” He concludes, “We have been adding more Vendor-Managed Inventory options to our portfolio. We realize that our customers may be dealing with the same lack of available employees that we go through, and are structuring our supply options to help them.”

Jason Kirby, President

2024 was a busy year for Central McGowan, as the company not only opened a new facility in Sioux Falls, SD, but also acquired Bemidji Welding Supply and The Safety Zone. That growth won’t slow down in 2025, as the company will be expanding into new markets and opening two new locations in Iowa with its entire product offering, according to President Jason Kirby. These strategic moves will help contribute to an anticipated 6% growth in 2025. “Interest rates need to come down to help with capital purchases as well as inflation. We need Agriculture to perform better than last year as well,” Kirby says. “I believe the new administration will have a positive impact on our economy as they will get inflation under control, bring down interest rates that will help with capital purchases. The question is, how long will it take? Probably Q3.” Overall, 2025 looks to continue to be an exciting time for Central McGowan!

Paul Rensing, CEO

“Trump influenced efforts to re-ignite the gas and oil business along with many other policies” will be the primary drivers of an anticipated 15% growth for Weld Plus, Inc. in 2025, according to CEO Paul Rensing. As others have noted, finding quality employees continues to be a struggle. “We are paying a lot more for our labor force,” says Rensing. With the anticipated growth this year, Rensing anticipates that inventory levels will need to rise to keep up with demand and quick deliveries. He concludes, “I think our entire industry will benefit from the new policies from the new administration. All manufacturing, in general, looks to improve opportunities, but oil and gas related should help Ohio, as well as the rest of the country.”

Troy Elmer, President

Mississippi Welders Supply Co., Inc.

MWSCO is forecasting growth of 5-8% in 2025, according to President Troy Elmer. However, as others have noted, a potential tariff war could put a damper on that forecast, if it escalates. He notes that, “We have seen our customers releasing funds for capital expenditures that were being held prior to the election. We anticipate this will continue for the next couple years.” The company opened a new location in 2022 that has been and will continue to be a growth driver for MWSCO. Concludes Elmer, “We need to get to a state where inflation is under control. It has slowed but price increases from vendors are still coming very often.”

Scott Kittleson, CEO

New business will be the primary driver of an anticipated 10-15% growth in 2025 for Maverick Oxygen, according to CEO Scott Kittleson. The company notes, as others have, the difficulty in finding quality labor for expansion. And while the company expects to see double-digit growth this year, it expects to see a more level year for the industry at large.

Brad Dunn, Executive Vice President

CK Supply, Inc. forecasts 8% growth in 2025 based on new business activity, capital equipment, and improved volume and gas to hardgoods mix, according to EVP Brad Dunn. “Consolidation is providing opportunities for service and community focused small businesses to succeed in attracting new customers and employees,” Dunn says. In addition to its growth projection, more exciting news to come in 2025, as the company expects to complete a new building expansion and dry ice facility in Kansas City this year and an entrance into a new market. Overall, this is shaping up to be an exciting year for the owners at CK!

Josh Davidhizar, Chief Financial Officer

“The overall productivity of our customers is going to be the main driver for our projections in 2025,” says Indiana Oxygen Company CFO Josh Davidhizar. “A lower interest rate environment, while not guaranteed, will increase the overall appetite for capital expenditures within our customer base.” The company projects a 3-5% increase in top line revenue in 2025. Says Davidhizar, “We have seen inflation, the supply chain, and even our workforce challenges even out in 2024.” He notes that IOC has seen good growth in the propane side of its business in recent years and expects the company to build on that success in 2025, the company’s 110th year in business! He concludes, “The dominant industry in our geographic footprint is fabrication and manufacturing which are expected to grow in 2025; however, tariffs may be a disruption for IOC and our customers. As such, we will remain flexible and seek strategies to ensure we are able to position our customers for success.”

Tony Parrish, Owner

The continuous growth in the company’s gas and dry ice segments, combined with the launch of a new B2B website to better serve its customers will contribute to an 8-10% growth for Evansville Welding Supply in 2025, according to Owner Tony Parrish. In addition to those factors, “I feel the new administration will boost confidence and have a positive impact on the economy and hopefully focus on regulation reform. We just keep our focus on growing the business and doing what’s right regardless of who is the President,” Parrish says. In addition to its new website, the company has made investments in additional sales staff, which should also help contribute to its anticipated growth in 2025.

Joe Winkle, Partner

Favorable market conditions will help contribute to an anticipated 6% growth for Weldstar this year, says Partner Joe Winkle, who notes the company is, “Moving more into technology-based products. We are improving our B-to-B software for easier transactions and easier research.” Over the past five years, Weldstar has added locations, which the company believes has the ability to bring in more new business, helping add to that growth forecast. Concludes Winkle, “We are always looking for new opportunities whether it be new products, or acquisition.”

Jon Berger, VP of Operations

While RV and Recreational Boat sales have been down for the past 18 months, lowered interest rates and a revived economic outlook has Berger Welding Supply, Inc. VP of Operations Jon Berger bullish on a turnaround for those two main areas of business for the company in 2025, leading to a projected 10% increase for the Plymouth, IN-based distributor. “New growth during a slow to moderate economy has always been good for us,” Berger says. “Business tax cuts and continued interest rate drops will drive our business partners,” he predicts.

Nathan Stringer, President

An increase in workforce, and an increase in coverage service, combined with an uptick in manufacturing jobs in 2025 lead B & R Industrial Supply President Nathan Stringer to project a 10-15% growth this year. “I think there will be a push in the oil & gas industry,” Stringer predicts. “Manufacturing should increase with the new administration. And jobs should come back to the USA, which should positively impact the economy.” He continues, “We are always looking to expand our business, by adding new products. Anytime you can help the customer cut cost it gives you the advantage.” The company added a location in the Gulf Coast two years ago, which continues to pay dividends and will help contribute to the expected growth in 2025.

West

Rounding out the regional surveys, the West Coast projects to see 7.88% growth in 2025, mirroring the other regions as similar to its 2024 projects where it projected 9.3% growth. As others have noted, some of that growth can be attributed to a pro-business environment, while some can be attributed to the lingering impacts of inflation and price increases.

Andy Castiglione, Regional Vice President

Price increases and new business will be the primary drivers in an anticipated 7% growth for WestAir in 2025, according to Regional Vice President Andy Castiglione. The company has invest heavily in bulk tankers and tube trailers in recent years to help grow its service capabilities. Says Castiglione, “Our customers in CA are very diversified. There are no new supply sources coming online so sourcing enough bulk product to service our growing demand will likely be a challenge.” In 2025, WestAir is opening its first fill plant and distribution center in the San Francisco Bay area. “We are also launching a new propane cylinder for the hospitality market as well as launching a new Hydrogen distribution system for the mobility market,” Castiglione says. The LA Basin and Bay Area are new geographies for WestAir and will help contribute to the growth projection for the company, as it celebrates its 55th anniversary in 2025.

Eric Moore, Sales Director

“The last 12 months we have implemented a new sales process to track and drive incremental growth. We have also upgraded our sales talent pool and are targeting new segments in the Southern California market,” says Cameron Welding Supply Sales Director Eric Moore. All told, those factors will contribute to a projected 7% increase for Cameron in 2025. “We see new incremental sale opportunities in the Aerospace, Food Processing, Automotive off road, Light Fabrication and Cannabis segments. These will be key focus areas for the Cameron Welding sales team in 2025. We have seen strong double-digit growth in the cannabis space over the last two years. Dry ice will be a strong focus for Cameron Welding in 2025.”

Dave Burnett, President

“We are expecting that the oil patch will increase activity during the last half of 2025,” says DJB Gas Services President Dave Burnett. This will help contribute to an anticipated 5-10% growth for the company this year, despite head winds in the steel and fabrication business due to the rise in interest rates. The company has tried to increase its productivity due to the continued workforce challenges seen across the industry. He notes that, despite the fact that they were not personally concerned about the election, “the market as a whole certainly slowed down during the last half of 2024.” He expects that will correct and the market will see a slight uptick in 2025.