No, we’re not talking about the Dave Matthews song, but that’s a nice lead in to a discussion of the volume range for CO2 between beverage and bulk. CO2 is a critical supply component in the beverage industry for fountains, taps, etc. First came cylinders, then a supply mode change to “bulk” filled onsite, which offered the advantages of eliminating product swap and supply interruptions. This led to an expansion of the microbulk model to the atmospheric gases. Both modes are long past new, but both are constantly looking for the next big move, and equipment suppliers are doing a good job with innovation and expansion of the model.

In the early ’90s, McDonald’s and the fast food industry led the charge to convert from cylinders to onsite CO2 fill and storage for beverage carbonation. Convenience and onstream reliability were the big bonus for the end user. But the business model for the supplier was a slightly more difficult fit — miles are money and they don’t earn you any revenue, and driving long distances in between stops with small drops is a losing proposition. While it could make sense for the end user to pay more per unit volume than they were for a cylinder swap, there is a limit to how much more they could be charged. Fortunately, the fast food industry is densely populated where routes can be scheduled to minimize miles and account for the small revenue drops.

On the other end of the spectrum, large bulk in 40-ton trailers makes no sense for drops like 500 lbs., which would be a good size beverage delivery. There are many difficulties with this process. One issue is that delivery access is often restricted and complicated. In addition, although the business model in large bulk does account for longer-range delivery, there is a limit to miles and drop size for the economics to work. We’ve all been there trying to convince our logistics department to deliver to a small tank in a remote zone, and it rarely, if ever, works. And site requirements are exponentially more difficult — installing a bulk tank requires a larger footprint, more complicated foundations and a more complex installation all around.

And ever the two shall meet…

Stepping outside of CO2 for a minute, an extension of the beverage business delivery model was developed in the late ’90s for atmospheric gases — enter the term microbulk. If it works for CO2, why can’t it work for the other stuff? Well it can and it has, but not exactly in the same way. For instance, the customer market density is much lower than in the beverage business and therefore larger-volume tanks to maximize the drop size are a factor, along with different physical properties between CO2 and the atmospherics.

So here we are now with robust supply chain modes for bulk beverage CO2, large bulk CO2 and the atmospheric microbulk business. And new trends in a few segments are calling for larger volume CO2, but not quite the large bulk volumes. This is the in-between customer, and we must find ways to make beverage fit small bulk and/or large bulk fit this new volume range.

Suppliers are cobbling together beverage tanks to fit the higher flow and volume needs in this new space and trying to find ways to rework the large bulk business down, but it’s been very difficult to meet the in-between customer. The smaller volume, early-version beverage trucks are disrupting the delivery model of multiple, small-volume drops with the occasional delivery that can empty a truck.

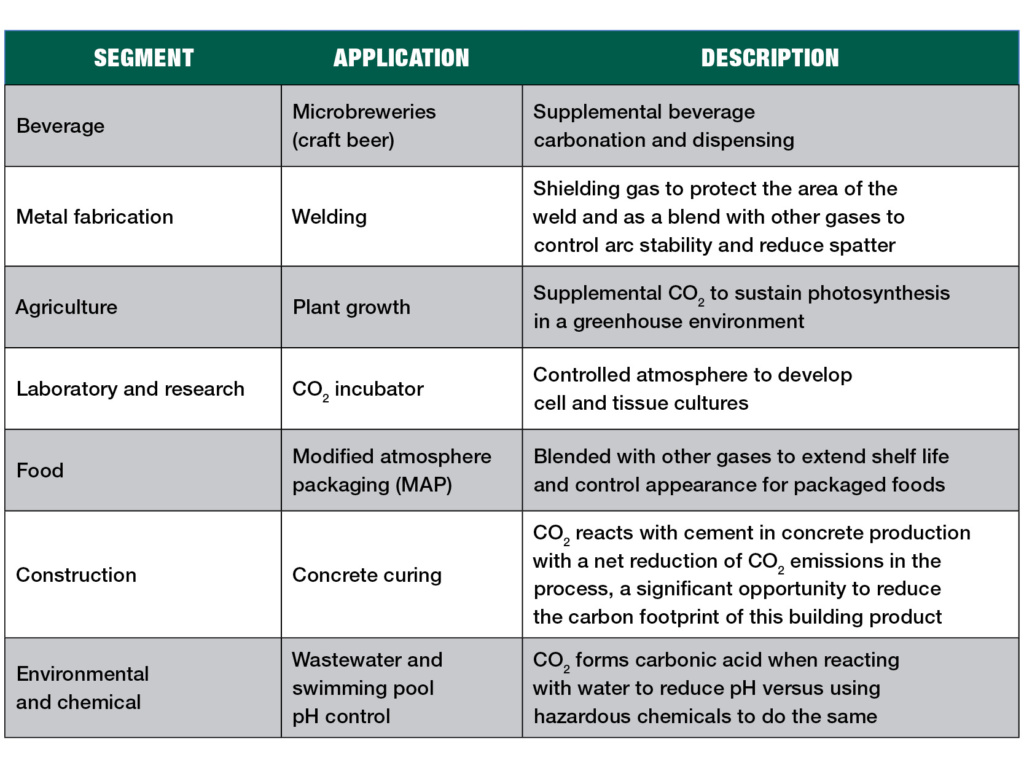

Applications

Where are these new applications coming from? Recent trends in craft beer, horticulture and construction to name a few. And although some applications have been there for a while, it’s time to recognize this CO2 volume segment as distinct with a supply chain fit for the purpose.

Equipment suppliers are now heeding the call. Recent product offerings in onsite storage and distribution/delivery equipment are addressing the needs of this segment. Chart Industries introduced a new line of storage systems, Perma-Max, designed specifically for CO2 service, with faster fill times and increased flow rates. The microbulk atmospheric model is expanding to leverage larger-volume CO2 supply.

According to Jeff Holyoak, director of business development and marketing at TOMCO2 Systems: “The industry continues to see an influx of smaller-volume CO2 applications including craft/microbrew, cannabis extraction and grow houses for enhanced crop yield where bulk trailer fills aren’t efficient or economical. TOMCO2 Systems continues to adapt by providing turnkey storage systems and expanding the capacity range of our Econo Body delivery truck line to include 5.5-ton to 10-ton capacities, enabling traditional bevcarb distributors to diversify their customer portfolio and expand their markets.”

Now the two business models on either side can allow customers and suppliers the best-fit supply mode for each operation. And what about marketing to this new segment? CO2 supply in these trending areas is critical. Make it known that you are focused with the right-size equipment best suited for this volume range. And while you’re at it, recognize the opportunities for additional wallet share and bundling opportunities with other products and services. High-value gases in the lab segment, welding equipment and supplies in the construction segment, nitrogen in the beverage segment and so on. Set your sales team up for campaigns to target this space and recognize profitable growth opportunities as an early adapter.

Perhaps now is the time for a name of this new space between, any ideas?