By John Campbell and Maura Garvey

We all experienced hardship and some real loss during 2020 with COVID-19. However, our industrial gas business pitched in to the treatment of COVID with strenuous efforts by providing significantly increased O2 to hospitals during the surges in cases and hospitalizations. That additional O2 assisted in treatment of the terrible patient breathing affliction with increases in O2 respiratory therapy and with higher volumes softening the very difficult intubation procedures. That O2 service will continue with the second surge well into 2021.

In mid-December, the fast development of the first COVD vaccines by Pfizer-bioNTech (Pfizer) and Moderna became reality as part of Operation Warp Speed (OWS) with the rollouts of the two mRNA vaccines. The challenge of those vaccines was that both were to be produced and distributed through a Cold Supply Chain; Pfizer’s ultracold at -94 F and Moderna’s at -4 F. In addition to O2, the industrial gas industry includes CO2 and Dry Ice and many other gases in our industry scope. Dry Ice has a working temperature of -109 F and excellent heat absorption attributes that fits nicely into Pfizer’s refrigeration plans.

Coincidently, Ken Thompson is joining Intelligas Consulting as part of the expansion of our Gases & Welding Distributor supply chain activity. Because the U.S. Distributor Type Business (DTB) is an increasingly important part of merchant U.S. CO2 and Dry Ice supply, our team decided to focus on the Pfizer Cold Supply Chain’s requirements for Dry Ice. Part of that was to understand the whole supply chain and to develop and document as much detail on Dry Ice demand and supply requirements. We have gained a good understanding of the demand and are now developing Dry Ice sourcing detail expecting that intelligence to be of value in the first and second quarter of 2021 when the complexities of the Pfizer Cold Supply Chain become more apparent in serving the U.S. hinterland. As part of Welding & Gases Today’s 2021 Forecasting Issue, we thought it useful to describe the Cold Supply Chain from a Dry Ice perspective in case that background would be useful to the DTB’s participation in Dry Ice supply.

OWS is a government-private sector enterprise under the overall direction of the U.S. CDC and DHS that has been planned and is being executed as if it were a military campaign. In fact, four-star Army General Gustave Perna is the chief operating officer of OWS. The development and testing of both mRNA vaccines took place at a speed few thought possible in the beginning of 2020. Those developments are quite complex and the supply chain of the vaccine production materials and support equipment and systems is a big story itself. We will discuss the Cold Supply Chain of the vaccines and the huge supply of vaccination “kit” from production to vaccination sites. Those points of use (POU) started out as major hospitals, nursing homes and other sites of critical health care providers, plus patients and residents of those sites and older folks of over 65 to 75 depending on the State.

While the responsibility for the supply chain to the state is planned and allocated federally by OWS, the supply chain within the state is planned and executed by the state in concert with the individual state’s transport system.

The vaccine production from Pfizer includes the mRNA genes from Andover, MA, and other production materials from St. Louis, MO, with assembly, testing and freezing of high quality glass vials of vaccine in Kalamazoo, MI. The kit to support the vaccination includes needles and syringes, saline solutions, alcohol swabs, and gloves. The Pfizer vials of vaccine contain 5 doses at -94 F, with 17-21 days required between the first and second dose. As agreed with OWS, Pfizer is handling the planning and execution of its supply chain from production all the way into the POU’s because of the challenges of controlling the ultracold vaccines and managing that difficult Cold Supply Chain. Maintenance of the -94 F temperature is critical, and any warming of the vaccine leads to rapid deterioration. The basic hold time at -94 F is 30 days. If a container of the vaccines is opened, the vaccines can be maintained in the box for up to 5 days. Without make-up Dry Ice to maintain the ultracold temperature, the vaccines spoil. The initial Pfizer rollouts of December 19, 2020 were by truck to aircraft to truck delivery to 635 POU’s with 2.9 million doses into all 50 states, a few territories, and some critical major cities, all in three days.

The Moderna vaccines are produced in MA and NH with packaging for delivery performed in Bloomington, IN. The Moderna vials hold 10 doses. The first and second doses have an 18 day separation. An important point is that the hold time in standard drugstore type refrigeration at 36 to 46 F for 6 months, a distinct advantage for the Moderna vaccine. On the distribution supply chain, Moderna and OWS agreed that Moderna’s vaccine would be managed by McKesson, the largest middleman in the pharmaceutical business. Later vaccine producers would also be managed by McKesson. Moderna was considered too small to handle the complexities of a large supply chain project. Also, the staging of additional vaccine players to the advanced Pfizer and Moderna programs would require complex real-time communications and management. McKesson has handled routine and emergency pharmaceutical supply chains for years and planned and managed the semi emergency of the last H1N1 flu vaccine distribution in 2009/10. That experience and a comprehensive existing contract with McKesson resulted in the OWS award to McKesson.

Both the combination of OWS, Pfizer, and McKesson chose FedEx, UPS, and DHL to handle the primary trucking and air transport through their company owned truck and aircraft fleets. FedEx will handle the Western U.S. and UPS the East. Primary supply to large POU’s (hospitals, federal penal institutions, pharmacy chains of CVS and Walgreens, etc.) will be direct by FedEx and UPS. Secondary supply from the primary hubs of FedEx and UPS will be contracted to other experienced secondary trucking firms. The several FedEx and UPS supply chain hubs are equipped with and manage advanced remote communications systems that track delivery conditions and locations and temperatures by container. Several UPS hubs now have Dry Ice making machinery for loading and make up of Dry Ice when needed and to supply customer requirements when useful. While FedEx currently sources hub Dry Ice requirements, they are planning for production of Dry Ice. Both player hubs are considering more advanced containers for handling ultralow temp refrigeration requirements. All of this planning and performance of advanced technology was originally planned for rollout in 2025 but has been accelerated because of COVID requirements.

The Supply Chain for both the Pfizer and Moderna vaccines from to POU’s uses specially designed thermal containers to contain the vials of the vaccines. The vaccination kits are assembled and delivered separately from their assembly points to the same POU’s. Detailing Pfizer and its requirement for Dry Ice, each vaccine special glass vial contains five doses at -94 F. The vials are packed into trays about the size of a pizza box, with the tray containing up to 195 vials. Five trays are packed into a specially designed highly insulated carton packed with about 50 lbs. of refined dry ice. That provides a max capacity per Pfizer shipping carton of 4,850 doses, or about .0105 lbs/dose (.164 oz/dose) for a shipper volume of DI. That equates to roughly 5 tons of Dry Ice per 1 million doses of Pfizer vaccine. If Pfizer could supply all of its commitments of 600 million doses in the U.S., including its purchase volume options, in 2021, that would represent a carton packing requirement of 3,000 tons of Dry Ice.

Let’s assume that the initial real Dry Ice volume requirement were to need a total round up system volume of three times that initial volume to handle losses and spoilage, refrigeration make-up at hubs and POU’s, and other supply chain inefficiencies. If that were true, that would require a total Dry Ice supply of 9,000 tons and a requirement two times that volume or 18,000 tons of LCO2 to feed that Dry Ice production, including conversion losses. Over a 250 day year, that would amount to 70 – 75 tons/day of LCO2 which is a small fraction of estimated U.S. total deliverable production of 25,000 tons per day (tpd). Note that UPS has hub Dry Ice capacity of 14 tpd of Dry Ice making capacity, requiring purchases of 26 tpd of LCO2. If the whole requirement were 10 times the above model’s requirement for the U.S. COVID rollout, that would amount to a 750 tpd total LCO2 required for COVID vaccine or 3% of U.S. production.

U.S. LCO2 and Dry Ice Business

At the end of 2020, U.S. nameplate (NP) LCO2 capacity from about 118 plants reached 36.4 thousand tons per day (ktpd), an increase of 1% from 2018, but only about 0.5% per year over the past five years. This capacity growth is not keeping up with CO2 demand, which is growing closer to 2.5% per year in food and Dry Ice applications. Annual production of liquid CO2 (LCO2) is about 10.2 million tons per year. The result is tight supply, with an 86% capacity utilization due to times of planned and unplanned plant outages and seasonal demand spikes and price increases. Five new sources with a total of 1,600 ktpd came onstream in 2019 and 2020. However, since 2018, several sources were idled, shut down, or had reduced feedstock due to COVID.

In late spring 2020, with the economy shut down and less automobiles on the road, 40% of Ethanol plants were idled. A small percent of those plants were supplying CO2, causing a sudden tight supply situation in April that had LCO2 suppliers and the food processors struggling to ensure food processing plants had enough supply to keep operating. That foreshadowed the concern for the Dry Ice in the planning of the Pfizer vaccine distribution, then forecast for early 2021.

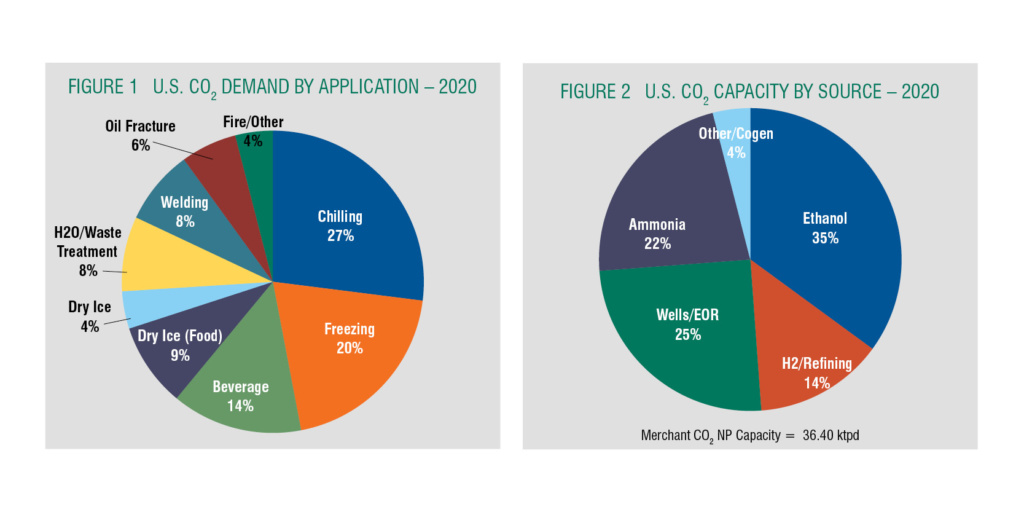

The merchant CO2 market is serviced by a complex supply chain where some companies are fully integrated in the CO2 supply chain from crude to pure to liquid distributed to end-users and distributors. Other companies buy crude from crude suppliers to produce and deliver LCO2 with some producing Dry Ice. Many are strictly distributors. As a product, CO2 is delivered in several forms, including as compressed gas in cylinders and liquid as bulk by tanker and micro-bulk, and a significant volume as solid Dry Ice. In terms of the U.S. markets for all modes of CO2 supply, food and beverage comprises almost 70% of the higher purity merchant CO2 supply as shown in Figure 1. This segment includes beverage carbonation and chilling, freezing and transport of food products. Dry Ice falls into this category in the form of blocks, pellets, and snow.

The industrial sector takes about a 30% of the U.S. market, for welding, water treatment, fire systems, blast cleaning, production of legalized cannabis, and oil field services like well workovers. Growing cannabis is a new fast-growing market, legal in 11 states and the District of Columbia for medical and recreational use.

Similar to helium, CO2 is a byproduct of a main supplier’s operations, so understanding the dynamics of the industries supplying the feedstock is critical to understanding CO2 supply. The majority of U.S. merchant CO2 is sourced from hydrocarbon conversion facilities where the primary product is ethanol, ammonia, hydrogen, and Wells/EOR as shown in Figure 2. This makes sourcing risky due to supplier planned and unplanned maintenance, supplier market conditions, and weather.

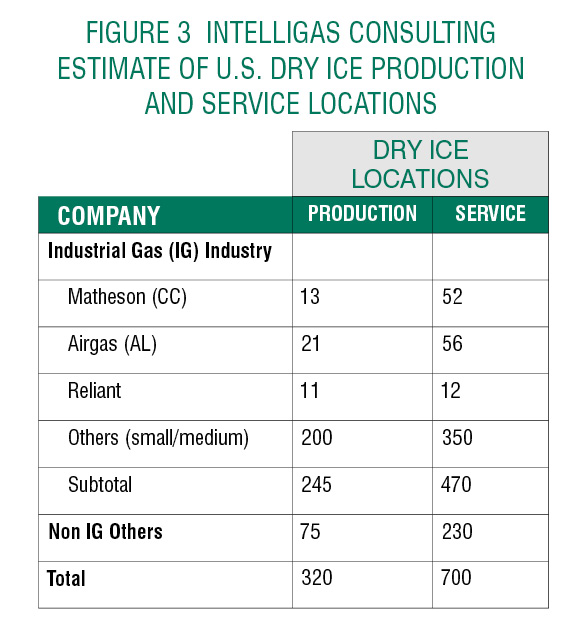

The acquisition of Airgas by Air Liquide in 2016 and the acquisitions of non-industry players EPCO by Air Products and Continental Carbonic by Matheson have made the major industrial gas players the dominant U.S. capacity shareholders of the merchant segment. Airgas and Matheson are the largest producers and suppliers of U.S. Dry Ice. Non-industry players have increased their share of the merchant CO2 business over the past 5 years from a 9% share to a 13% share. Reliant has a 7% share of CO2 production capacity after their acquisition of Flo CO2 and 2 spin-off plants from the Air Liquide acquisition of Airgas. Poet acquired Ethanol Products and has a 5% market share. Other small companies account for another 2% share. We expect to see growth in the non-industry players going forward in this very important and profitable CO2 market.

Current CO2 production of Dry Ice from primary producers of LCO2 and Dry Ice manufacturers is 1.2 million tons per year (tpy), requiring 2.0 million tpy of LCO2 because of the loses in conversion from LCO2 to ice.

In addition to the primary producers of the industrial gas industry where Dry Ice is produced and delivered from LCO2, there are many sources of Dry Ice from non-Industrial Gas (IG) companies including:

- Specialized Medical and Specialty products distributors supplying the Healthcare and Institutional Medical, Food Processing and Delivery, R&D, Laboratory, etc. businesses,

- Refrigeration requirements of many recreational activities, and

- Transportation distribution companies such as UPS and FedEx that will be significantly involved in the distribution of Covid-19 vaccines.

We expect to have a more detailed view of Dry Ice availability from the industrial gas DTB players and the dry ice providers in more specialized businesses like medical materials & equipment suppliers, those in specialty R&D supply, entertainment systems, etc. in early 2021.