The GAWDA Consultant Program is a GAWDA member benefit that is included as part of your member dues to the association. It is consistently rated as one of the most valuable member benefits that GAWDA provides. Between the four of them, GAWDA’s consultants bring more than 100 years of industry-specific experience to the association.

In the first three issues of 2022, we spoke with the consultants about a variety of topics that impacted businesses in 2022. From recently passed or upcoming legislation, to the continued impact of COVID, to an increased frequency of inspections. For our final issue of 2022, GAWDA’s Consultants discussed the bevy of new legislation and proposed legislation and how it will impact members heading into 2023. We also discussed important record-keeping documentation to take care of ahead of January 1.

Thank you to Tom Badstubner, GAWDA’s FDA and Medical Gases Consultant, Marilyn Dempsey, DHS, EPA and OSHA Consultant, Mike Dodd, DOT Consultant, and Rick Schweitzer, Government Affairs and Human Resources Consultant, for lending their time and expertise to discuss these important topics. The following is a lightly edited transcript of that conversation.

Welding & Gases Today: Is there anything new or time-sensitive that we want to keep our members abreast of to start off with?

Tom Badstubner: From an FDA perspective, the biggest news in a couple of generations is the proposed new medical gas regulations. CGA and GAWDA have submitted joint medical gas industry comments to those proposed regulations. We think that there isn’t going to be huge operational differences, but there will be some new procedures that we will need to adopt. And we will certainly keep GAWDA members informed of changes as the FDA considers our recommendations.

WGT: What is the timeline for that?

Tom: On May 23rd, the proposed regulations were published. On August 18th, we submitted our comments. Now the FDA is in a comment review period that could be quick… or it could take years. A summary of our major comments:

Effective date – We requested that the final rule be effective by March 31, 2023. We would have another 18 months to implement the new regulations.

Definitions – We suggested clarifications to the different types of medical gas manufacturer (original, subsequent, and curbside filler). We also suggested clarifications to the differences between homecare base units and portable cryogenic containers.

Plumbers – (21 CFR 201.100) We proposed that plumbers/pipe fitters should not need a prescription when purging a medical gas pipeline with medical nitrogen.

Open-top dewars – (21 CFR 201.100) We proposed that liquid nitrogen in open-topped dewars for dermatologists not be labeled with drug labels.

Devices – (21 CFR 201.161) We proposed that medical devices that use liquid oxygen in homecare settings use the device label.

No Smoking/No Vaping – (21 CFR 201.161) The FDA proposed new labeling to inform oxygen users about the dangers of smoking or vaping while using oxygen. We expressed our concern about the label design and practical space as well as the time needed to implement this proposed change.

Receiving bulk medical gases – (21 CFR 213.82) We proposed that the receiving location could perform full USP testing in lieu of using a Certificate of Analysis from the supplier.

Receiving bulk medical gases – (21 CFR 213.82) We deleted the requirement to add NDA numbers to Certificates of Analysis since commingled product makes the NDA number meaningless.

Leak testing – (21 CFR 213.84 – Preamble) We explained that leak testing after the cylinder leaves our control is impossible and outside GMP.

Container gauges – (21 CFR 213.94(e)) We proposed clarifications about liquid level and pressure gauges on cryogenic containers.

Cleaning and maintenance – (21 CFR 213.182) We proposed to maintain historical management of cleaning and maintenance.

Batch Production and Control Records – (21 CFR 213.189) The FDA proposed to have label specimens attached to fill logs. We proposed to eliminate the requirement.

Batch Production and Control Records – (21 CFR 213.189) The FDA proposed to include both date and times on the fill logs. We proposed to eliminate the requirement.

Distribution records – (21 CFR 213.196) The FDA proposed to eliminate the existing medical gas exemption for including lot numbers on distribution records. We proposed to reinstate the exemption.

RPV valves – (21 CFR 213.204) In the 2007 draft guidance, the FDA introduced the concept that using Residual Pressure Valves might allow us to not consider the gas in returning cylinders as “residual gas.” This concept was not in the proposed regulations, and we reintroduced the idea.

Annual report – (21 CFR 230.80) This is a new section (Subpart 230) of the regulations that includes the procedure to assign a New Drug Application (NDA) number to original manufacturers of medical gases. This process is presently documented in draft guidance. This paragraph (.80) specified that an annual report is due on the anniversary of the NDA issuance. We proposed that the period of the report be a calendar year and harmonize with the existing CARES reporting and Drug Product Listing requirements.

Field alert report – (21 CFR 230.205) The FDA proposed a field alert report (FAR) to be sent within three days by the NDA holder in certain serious cases (mixups, contamination, etc.). We propose that the FAR could also be sent by the subsequent manufacturer since they are often closer to the situation than the ASU.

Incident reports (ICSR) – (21 CFR 220.220 and .230) We propose clarifications to the incident reports, literature references and their report contents.

Remember, these are only comments to proposed regulations. Please do not make changes to your labels or procedures until we see what the FDA accepts and publishes. We do not know how long the FDA will need to review our comments.

Even after the FDA publishes the final regulations, we have 18 months to adopt them. So, I wouldn’t make any changes right now.

WGT: How about the other agencies? Is there anything to report?

Mike Dodd: I’ve got something for DOT. Every year, by January 1st, our members have to do what is known as a Unified Carrier Registration. Basically, they pay a fee based on the number of powered commercial vehicles they have that are used in interstate commerce. That definition of interstate commerce basically means that it will involve every distributor in our country. Almost every one of our members will buy hardgoods material from outside their state. And when they put those on their trucks to deliver them, they continue that interstate commerce.

We used to think that we only had to pay on the trucks that left the state and crossed state lines. But they came back with some clarification on what they considered interstate commerce and we found that they didn’t necessarily have to leave the state in order to be considered. So, that has changed how I have told members to count the number of powered commercial vehicles. Most of our members are doing it already, but every now and then I run across a member who doesn’t know that definition.

It’s called the Unified Carrier Registration. I call it a nuisance fee or a tax, but in conclusion, you have to pay based on the number of vehicles that are considered to have taken part in interstate commerce. Just their CMV’s or placarded vehicles.

Rick Schweitzer: You pay it to a base state. So, whatever state you’re located in, you declare that as your base state. And you pay it on an annual basis. And there are five categories of numbers of vehicles. So, if you have 0-1 or 2-5, you pay a flat rate based on the number of vehicles that you register.

Speaking of fees and taxes, I have one from our friends at the IRS. It’s their new superfund chemical excise taxes that went into effect for the third quarter 2022. This is a reinstatement of taxes that were essentially suspended back in the Clinton Administration but have always been on the books. And it’s part of the Biden Administration’s war on hydrocarbons. This is a tax on the sale or use of taxable chemicals that are listed in one part of the statutes. And then a separate tax on the sale or use of imported taxable substances in a different part of the IRS code. But, for taxable chemicals, for most GAWDA members, this is going to include acetylene, butane, propylene, toluene, xylene, ethylene, and methane. And it is a tax of a flat rate per ton. And you pay this on a quarterly basis using IRS form 6627, which is environmental taxes, and it is attached to your form 720 quarterly federal excise tax return. The first payment is due by October 31 of this year for the calendar quarter that will end September 30.

This is a new tax that is in effect now and there are FAQs online, if you google IRS Superfund Chemical Excise Tax FAQs, there is a whole page that will answer virtually all of your questions (https://www.irs.gov/newsroom/irs-issues-superfund-chemical-excise-taxes-faqs).

Marilyn Dempsey: For my areas, DHS, EPA and OSHA there aren’t any time sensitive issues at the moment. The National Emphasis Program for Outdoor and Indoor Heat-Related Hazards is still active, but by the time this article is released we will be starting to get into the cooler part of the year. We do have to remember the program does have two-year more years of enforcement.

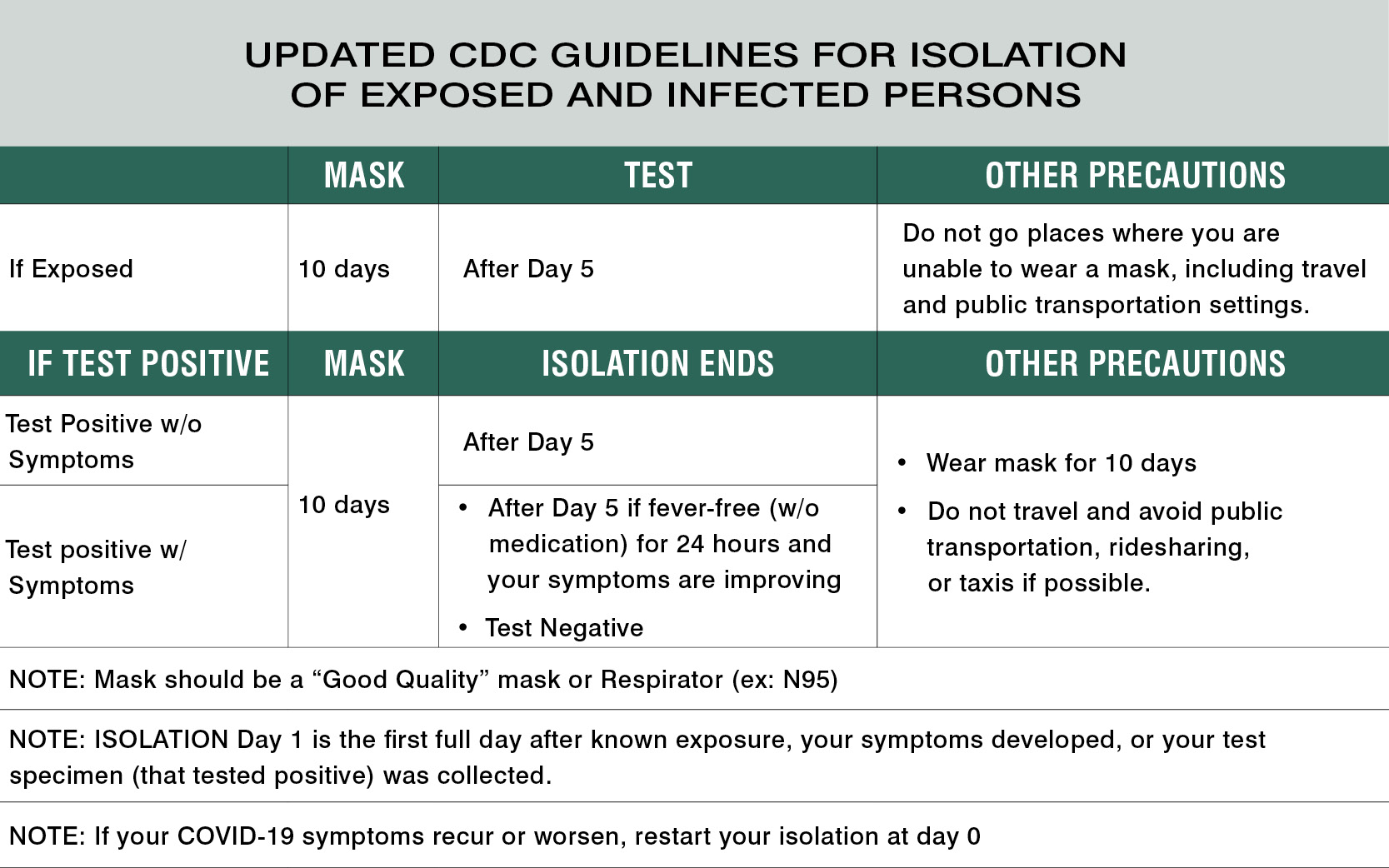

Also, COVID-19 is a national emphasis program. COVID is still a pandemic. It is not an endemic yet. And we’re seeing COVID pop its ugly little head up in different places around the country. It is worth noting the CDC has changed the guidelines for isolation of exposed and infected persons (see chart).

CDC Website: https://www.cdc.gov/coronavirus/2019-ncov/your-health/isolation.html (11Aug2022)

WGT: Is there anything that is going to be due on the first of the year or early in the year that members have to take care of?

Marilyn: Yes, SARA Title III is due March 1st and don’t forget that before that is OSHA 300A. All companies with 10+ employees must record injuries/illnesses and those companies must post the previous year OSHA 300A form from Feb 1 – April 30, in an area visible to all employees. Establishments with 250 or more employees or with 20 – 249 employees in certain high-risk industries must electronically submit their 300A to OSHA by March 2nd of the current year. If you have the NAICS code:

- 325120, Industrial Gas Manufacturing – Air separation and Acetylene plants

- 423840, Industrial Supplies Merchant; Welding Supplies Wholesalers

- 424690, Welding Gases, Other Chemical and Allied Products Merchant Wholesalers

- 454390, Other Direct Selling Establishments

If you are required to submit, then you must do so annually here: https://www.osha.gov/injuryreporting.

So, if the injury and illness files are a mess, it’s a good time to clean those up.

Mike: One more thing, there’s a February 15th deadline where the distributor has to inform their customer if they’re going to make the March 1st report for SARA Title III or if they need the customer to.

Marilyn: Correct. Every March 1, an EPA Tier II form is required to be filed under Section 312, also called the Emergency Planning and Community Right-to-know Act (EPCRA). The intent of the Tier II form is to provide information about the potential hazards at your worksite with your State Emergency Response Commission, Local Emergency Planning Commission and local Fire department.

You must file a SARA Tier II if you:

- Have equal or greater than 10,000# of any hazardous chemical, as determined by OSHA.

- If at any time during a calendar year your facility stored a hazardous material listed on the EPA Extremely Hazardous Substance list over the threshold planning quantity (TPQ).

- The Local Emergency Planning Committee (LEPC) needs, you to submit an SDS for Hazardous chemical if your LEPC and State Emergency Response Commission (SERC) or fire department asks you to submit Tier II then the threshold level for reporting is zero.

In addition to the products at your facility, you must also consider bulk products stored at your customer locations. For example:

- If Bulk storage tanks/trailers at customer locations and owned by YOUR company, then your company has an obligation, under EPCRA 312, to notify the customer of their obligation to report under SARA Tier II for any hazardous material that is at or above the reporting threshold. Or you could file the report for them as an additional service.

Notification to the customer must be made by February 15, in a separate letter (not a note on a billing statement) listing the chemicals you provide that require Tier II reporting and where they can find the appropriate forms. - If THEY own the bulk tank, you are not obligated to notify the customer, but it is good customer service.

Unless you have language in the contract stating it is the responsibility of the customer to comply with all EPCRA obligations. - Hospitals are exempt from the Tier II reporting and your notification requirement under EPCRA 311 and 40 CFR 370.2 and 355.2. This exemption allows the exclusion of any “hazardous chemical” that is used for research, medical facility, or hospital if they have a technically qualified direct supervisor.

However, you should check your state and local regulations, because some jurisdictions still require reporting by the medical facility.

Another agency I would like to mention regarding reporting by the end of the year is DHS. If you brought on any new chemicals or increased your inventory, you should check Appendix A of part 27 to ensure you’re below the threshold limit.

Tom: From an FDA perspective, end of the year is registration season for food, warehouses, and production facilities and drug production facilities. In addition to that, twice per year, in June and December, we’re supposed to be looking at our drug product listings and making sure that they’re accurate. So those are coming up now.

WGT: The Inflation Reduction Act has been in the news. Is there anything coming out of that will impact GAWDA members?

Rick: Nothing that is going to reduce inflation. But it does include a number of provisions addressing climate change and health care in addition to several tax changes. Some significant last-minute changes to the bill were obtained by Sen. Joe Manchin (D-WV) in order to secure his vote for passage. The new law:

- Includes a tax credit for qualified commercial clean vehicles from 2023 to 2032, calculated as the lesser of (A) 15% of the basis of such vehicle (30% in the case of a vehicle not powered by a gasoline or diesel internal combustion engine), or (B) the incremental cost of such vehicle, defined as “an amount equal to the excess of the purchase price for such vehicle over such price of a comparable vehicle.” The credit is capped at $7,500 for any vehicle with a gross weight rating of less than 14,000 lbs. and $40,000 for other commercial vehicles. Only qualified commercial electric and fuel cell vehicles may receive the full credit; internal combustion engines are eligible for a reduced credit of 15%.

- Establishes a new 15% alternative minimum tax on certain corporations, including U.S.-headquartered corporations with at least $1 billion in annual global revenue.

- Imposes a one percent excise tax on the fair market value of stock repurchases by publicly traded companies.

- Beginning January 1, 2023, reinstates Superfund excise taxes on crude oil and imported petroleum products that expired in 1995, at a new rate of 16.4 cents-per-barrel (up from the previous rate of 9.7 cents-per-barrel), which will be indexed to inflation.

- Increases funding for the Internal Revenue Service by $79 billion through fiscal year 2031 for enforcement purposes.

- Authorizes spending $375 billion through fiscal year 2031 to address climate change, including $4.5 billion in subsidies, tax credits and rebates for residential electrification (e.g., purchases of electric appliances and heat pumps).

- Consolidates all tax incentives for renewable and alternative fuels into a single performance-based “clean fuel production credit” in tax years 2025-2027. The base value is $0.20 per gallon for fuels with a lifecycle emissions level below 50 kilograms of CO2e per mmBTU, with further adjustments to credit value based on and “emissions factor.” The rate will be indexed for inflation.

- Conditions issuing rights of way for utility-scale scale renewable energy projects on public land unless 62 million acres of federal lands and waters are offered for oil and gas leasing each year for ten years.

- Revives oil and gas lease sales in Alaska and the Gulf of Mexico previously canceled by the Biden Administration.

- Includes $500 million over ten years for downstream biofuel infrastructure grants.

- Extends without changes the renewable and alternative fuels tax incentives through 2024, including biodiesel and renewable diesel blenders’ tax credit, the second generation (cellulosic) biofuel producer credit, and alternative fuel mixture (propane autogas) tax credit.

- Authorizes Medicare to negotiate certain prescription drug prices and imposes caps on certain drug process.

WGT: Marilyn, you brought up the idea of COVID rearing its head. How about the new panic on the street? Anything we need to be aware of with Monkeypox?

Marilyn: Not that I know of. It is increasing and they’re trying to come up with a vaccine for Monkeypox. Currently there are 46,724 cases worldwide and 16,926 in the U.S (August 22, 2022). Most cases are white men between the ages of 21-41. (CDC, 21 Aug 2022). According to the CDC, “Monkeypox can spread from person to person through direct contact with the infectious rash, scabs, or body fluids. It also can be spread by respiratory secretions during prolonged, face-to-face contact, or during intimate physical contact, such as kissing, cuddling, or sex.

Monkeypox can spread from the time symptoms start until the rash has fully healed and a fresh layer of skin has formed. Anyone in close personal contact with a person with monkeypox can get it and should take steps to protect themselves.” (CDC Frequently Asked Questions about Monkeypox. August 22, 2022. https://www.cdc.gov/poxvirus/monkeypox/faq.html).

On another topic, there is a CO2 shortage that is putting a strain on the industry, especially during peak CO2 season, which is May-October. The shortage has one benefit, it should help with CO2 cylinder allocation. I mention this because I believe GAWDA members who distribute CO2 for the cannabis industry should be vigilant and keep their Cannabis cylinders separate from other populations since there have been instances of cannabinoid contamination in CO2 cylinders…and you don’t want to sell CO2 with a marijuana odor to a restaurant.

WGT: From an FDA perspective, is this CO2 shortage having a major impact on restaurants?

Marilyn: I’ve heard about microbreweries.

Mike: That’s what I’ve heard, too. I’ve heard a lot have had to close because they can’t get CO2.

Tom: The issue is where can you get CO2? I have had a few requests in the last month or so about alternate CO2 suppliers in different regions. It’s really just a supply chain issue. It isn’t a regulatory issue.

WGT: Is this something where the finish line is in sight or is this shortage something we’re going to have to deal with for a while?

Tom: I think the supply chain issue is related to the ethanol plants being reduced. So much less CO2 is coming into the market.

Mike: I think you nailed it, Tom. It’s a supply issue. Demand is up and sources are down.

WGT: Is there anything that is going to be on the agenda for your respective committees during Convention that you want to share with the readers?

Marilyn: One of the things that the safety committee does is that they come out with these safety practices and the distributor members take advantage of them. But the supplier members can also use a lot of that information. I think it’s important that the supplier members know that we consultants work for them, also. We don’t only work with the distributors. The Safety Committee has focused on standardizing the Sample Safety Practices to make it easier to find and to read. Here is a list of the new and reformatted/reviewed/revised Safety Practices for 2022:

New Sample Safety Practices – 2022

- Insect Bites and Stings Prevention

- Heat Related Illness Prevention

Reviewed, Revised and Reformatted Sample Safety Practices

- Active Shooter Emergency Preparedness

- Backing and Parking

- Bloodborne Pathogen Program

- Canine Bites, Awareness and Mitigation

- Contractor Safety Requirements Agreement

- Customer Safety at Member Sites

- Cylinder Connection at Customer Sites

- Cylinder Loading Dock Safety

- Cylinder Deliveries at Customers with Stairs and Ramps

- Cylinders – Guidelines for Leaking Cylinders at Customer Locations

- Cylinders – Safe Handling of

- Delivery Survey

- Docking Ramps – Selection and Use of

- Driver Distractions Personal Communication Devices

- Dry Ice Sample Safety Practice End User Guide

- Earthquake Emergency Preparedness

- Electronic Submission of Injury and Illness Records to OSHA

- Emergency Preparedness

- Ergonomics in the Workplace

- Facility Securement

- Fall Protection

- Fill Plant PPE

- Fire Emergency Preparedness

- Flood Emergency Preparedness

- Forklift Cylinder safety

- Load Securement

- LPG – Vendor Audit Checklist

- Mechanical Lifting Devices

- Regulatory Agency Visit Guideline

- Slips, Trips, and Falls Guidelines

- Tornado Emergency Preparedness

- Transport of Pressurized Cryogenic Liquid Containers in an Elevator

- Vehicular Accident/ Incident Considerations

- Walking Working Surfaces

Mike: CGA will announce their safety awards at Convention. They announce a “Most Improved Distributor” and we have several of our members who we have worked with that have won that. We have even had a couple of repeats. It really is a pretty prestigious award that is given by CGA to one of our members.

Tom: Also, two weeks after the GAWDA Annual Convention will be the Professional Compliance Seminar. There are still some virtual seats available to attend. We will be at Weldcoa from October 18-20. It will be an in-person event with a virtual option for those who can’t join us in-person at Weldcoa.

Mike: This is our first in-person seminar in three years.

WGT: What’s the elevator pitch for the Professional Compliance Seminar? Why do I need to attend?

Tom: From an FDA perspective, we’ll be covering basic Current Good Manufacturing Practices (CGMP) and the potential effects of the proposed regulations mentioned above on Tuesday, October 18, which is the first day of the conference.

Mike: I’ll be doing high-pressure cylinder filling. High-pressure CO2 liquid container filling. And, of course, answering DOT questions. One of the biggest things is that it gives a chance for the members, specifically those who attend in person, to talk to each other during the breaks and before and after class. There is an awful lot of interaction and networking that will happen. And it seems like we get much better interaction and back-and-forth with the speakers during the in-person sessions. People seem to be much more open to asking questions and talking.

I’m really looking forward to it. It makes it a lot more fun for us, as the presenters, to have the in-person and I think attendees get more out of it.

Marilyn: You just did an interview with Randy Squibb. Randy talked about the importance of making connections and gave an example of a problem he had down in Texas; he called his buddy was up in Wisconsin to get his feedback and run through some options. That type of relationship only develops when you have good personal interaction. It gives you a knowledge base.

That is why I am so grateful to be back in person for the Professional Compliance Seminar. My presentation will focus on the elements of an OSHA safety program because the way to improve your safety score, improve the safety perception of the company and save the company money is to learn how to be a safer company. And not just OSHA but also a safer company for DHS, EPA, DOT and FDA compliance. The seminar is an easy way to actually build your knowledge base for a relatively small out-of-pocket cost (money and time). You not only get the education, but you will also build relationships with other GAWDA members.

WGT: Any last thoughts before we go?

Marilyn: Rick, you have all the IRS agents that are about to be hired. All three of my agencies have their “For Hire” signs out. The Government is hiring.

Rick: Part of the Inflation Reduction Act is attending to hire 87,000 new IRS agents.

WGT: Touching on politics, this will be our last issue before Midterms. Anything to say on that, Rick?

Rick: It’s going to be a new Congress in January. The House is expected to change hands. It’s going to be a whole new ball game to see what they’re emphasizing and what they’re investigating.