By Ken Thompson

What is the common thread in mentoring our family-owned business successors and responding to forces seeking their disintermediation from the supply chain?

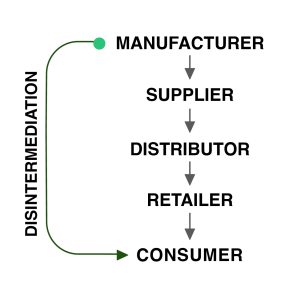

Disintermediation – what a mouth full of syllables – and, once we get it past the lips, do we know what it means? You bet! It means someone wants to remove you from your place in the supply chain and take your piece of the pie for themselves. Sound like “fighting words” to you?

Disruption comes in many flavors. And every time a new one surfaces, it forces us to look at ourselves in the mirror and reevaluate and measure our true value as a supply chain partner. What we may have considered a unique contribution a few years ago could have easily succumbed to new technology that has converted a complex task to something satisfied with a simple key stroke.

Several highly respected industrial distribution industry resources are creating serious awareness to the latest distribution business visions, strategies, and execution.

The digitization taking place in many distribution industry models is serious business and cannot be ignored. Modern Distribution Management, in a recent webinar, presented undeniable data relative to the enormous amount of Private Equity money and M&A consolidation efforts to disintermediate small, digitally challenged, under-capitalized players from the supply chains. Distribution Strategy Group suggested that small family-owned businesses must choose between serious commitments and related investments in digitization platforms or succumb to acquisition by larger dominant players.

Some in the packaged gases and welding supplies distributorship vertical will recall a similar effort to disintermediate us from the supply chain in the mid-1980s. On that occasion, the Arthur Andersen Consulting Group sponsored ‘Facing the Forces of Change’ studies. Those studies suggested that the combination of exploding emergence of Industry

Buying Groups, with the primary purpose of leveraging lower product costs, and the formation of supply chain integrators would encumber gross margins to the point that intermediate suppliers would be unable to fiscally prosper, or even survive.

During the 80s, GAWDA’s predecessor, NWSA, rallied the industry players to identify a distributor’s value proposition to both customers and suppliers. We played an important role, and it went far beyond the simple cost and selling price of goods and services. It meant identifying meaningful services provided and substantiating measurable value. Much of this work was accomplished by the second-generation owners who possessed skills and had tools available that did not exist for the benefit of Dads or Granddads.

Parallel to this, we witnessed the “aging out” of many owners without any sons interested in perpetuating the family business. Airgas surfaced as a major consolidator of family-owned businesses, and fairly compensated retiring owners in the acquisition processes. Others would follow the Airgas model, and our industry distributor population was reduced from a couple thousand to several hundred.

If we accept disintermediation as inevitable, another round of consolidation might occur.

However, a succession “safety valve” has appeared in two dimensions. First is a very significant emergence of highly qualified women with sincere interest in succeeding their male counterparts – be it dads or brothers. Our footprints have expanded to the point where the business models are no longer heavily concentrated in a less than attractive “arcs and sparks” atmosphere. Medical, research, cryogenic, and process gases, food and beverage CO2, safety and MRO supplies creates a pleasing mix that makes these companies and the relationships that accompany them pleasing to women. The second alternative to the absence of male-only family succession, is the adoption of ESOP models. This rewards a host of loyal business associates with an ownership stake, a route to security and professional growth, and removes the fear of integration into a foreign or unfamiliar business atmosphere.

In each instance, extension of the presence of successful small privately owned companies is a pleasing alternative to more consolidation.

We should pause for a moment and reflect on the value these ownership alternatives mean to our industry’s future. It effectively more than doubles the pool of talent necessary to carry our companies forward. Notably, in the case of women joining a formerly male dominated distribution vertical. Looking back, Women in Welding is not something brand new. The Stoddard family, owners and managers of H & M Pipe Beveling Machine Company is well into the third generation of a woman owned business. They were indeed ‘trailblazers’ in NWSA/GAWDA. They enthusiastically supported our association with presence, resources, volunteerism, and ideas. Shannon Fanning, their sales executive, never missed a meeting, and clearly represented herself exceedingly well in both male dominated golf outings, as well as leaving the gin rummy table with a coin purse heavier than it was on her arrival.

Today, our ladies have built a strong Women of Gases and Welding resource group, offering multiple networking exchange opportunities, populating committees, and are well embedded in the chairs of leadership.

We have all been mentored by someone, and today are seen as a mentor by someone else. Some of these activities are formalized, others are simply habits, words, or actions observed and absorbed. Mentoring in today’s circumstances takes on growing importance. First, because growth opportunities are extended to a wider range of candidates. Second, because generational change has introduced a whole new set of technology tools where skill sets reside in younger associates’ repertoires. It is these skills that are necessary to keep pace with or remain ahead of the industry changing technology curves. Skill sets perfected by younger associates, experiences shared by veteran managers, and the welcoming atmosphere of trade association activities highlighting ladies’ interests is a mentoring mix hard to beat!

Keep it going, GAWDA!