Improvements Are Required inCommunications Between Manufacturer, Distributor and the Customer

by J. R. (Buzz) Campbell & Ken Thompson

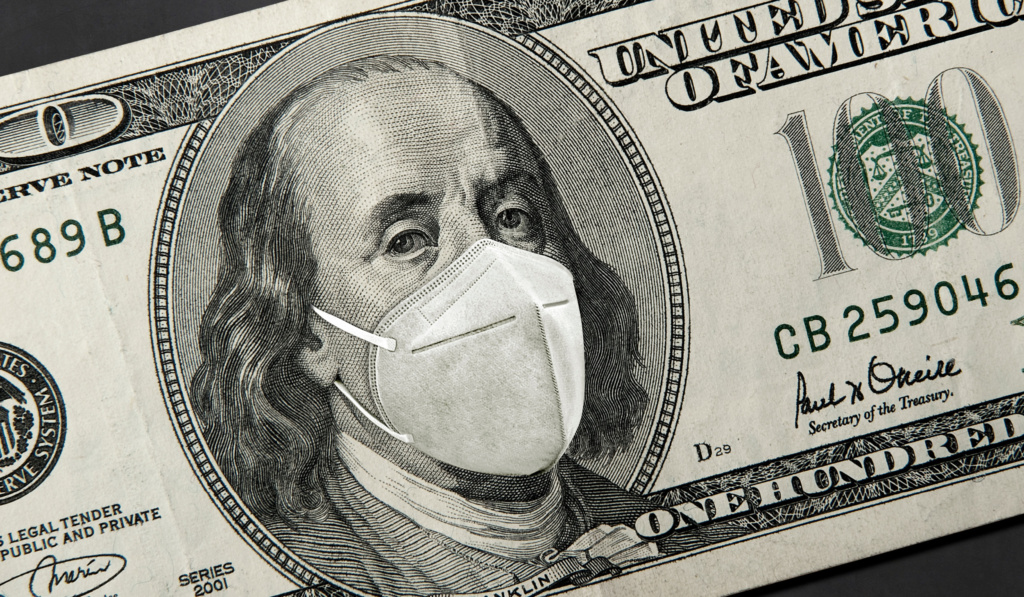

In this article, we’ll look at what’s happened in the U.S. economy relative to our Gases and Hardgoods (HG) business, make a quick review of three of the biggest Gas Majors’ first calendar half for 2020 (H1/20) financial reports, review some key products and markets affected by the Coronavirus pandemic (COVID), and discuss new challenges in selling and the need for further integration of communications between the manufacturer, distributor and customer in Hardgoods.

According to the July 30, 2020, U.S. Bureau of Economic Analysis (BEA) Report, the Q1/20 U.S. GDP dropped 3.4% from Q4/19, with Q2/20 dropping 34.3% from Q1/20 (in current $, annual rates). The Q2/20 drop was annualized as $2.15 trillion (or a $537 billion actual for 2Q20). While a significant part of the Q1/20 drop was in Durable Goods, the Q2/20 drop included drops from Non-Residential construction and Non-Durable Goods, with a huge drop in Services. As many of you are experiencing, these abrupt changes have significantly affected the U.S. hardgoods side of our businesses, with the U.S. gases segment more moderately impacted.

Three major Gas Companies: Air Liquide, Air Products, and Linde, reported their H1/20 with those results in late July showing the following of interest:

- Air Liquide – H1/20 world revenues for 2020 of $12.2 B (?10.3B, “comparable”) were reduced from the same period in 2019 by -3.2%; with Q2/20 reduced from Q2/19 by -6.9%. Total Gases & Services sales represents 96% of total world sales. H1/20 Gases & Services-Americas, was about $4.7B or 39% of world revenues, with that segment’s Q2/20 sales reduced by -6.5% from Q2/19.

- Air Products – H1/20 world revenues of $4.3B were reduced from the same period of 2019 by -3%, with Q2/20 reduced by -7% from Q2/19. Total Industrial Gases sales represent 94% of world sales. Industrial Gases-Americas sales represent $1.8B or 42% of total world sales, with Q2/20 reduced from Q2/19 by -11%.

- Linde – H1/20 world sales of $13.1B were reduced from the same period in 2019 by -2.7%, with Q2/20 reduced by -13% from Q2/19. With engineering representing a significant part of total Linde world revenues, Industrial Gas revenues represent about 85% of total world sales. For H1/20 revenues for Gases-Americas was $5.1B roughly 39% of total world sales, with Q2/20 reduced by -6.5% from Q2/19.

The 2019 run rate for the combination of the above three companies indicates a total aggregate annual revenue run rate of about $60B. The current aggregate Market Cap for those three companies is about $235B, or about four times the combined 2019 revenue run rate. We further estimate that the three companies generate gas and related revenues, excluding hardgoods, of $19.5B in the U.S., with another $4.2B generated from Canada, Mexico, and South America.

This is a clear indication that investment in the world’s industrial gases businesses, though a comparatively small business, is generating a healthy return for its operators and investors. Another observation relative to the current COVID difficulties is that a large part of our gases business is based on long-life fixed assets, the cost and profit of which are covered by long-term supply agreements with steady coverage of all costs and a continuing stream of positive cash flows. That, plus our relatively low employment costs, provides a combination of employment opportunity and stability in the face of COVID business challenges.

Finally, our industry is strategically placed to service a large combination of the world’s primary resource businesses, as well as the future expansion of high-tech, including the solutions to the two looming problems of climate change and universal health challenges.

While the combination of these three Gases-Americas players took a profit hit in the Q2/20 of -7.5% year-on-year (YOY), the industries “distributor type businesses” (DTB’s) took a much larger hit, with their mix favoring a heavy mix of hardgoods revenues, which took a big revenue and income toll from the COVID pandemic. In an interview with Maura Garvey of Intelligas Consulting, Garvey provided some positive insights on the first half of 2020, with specific relevance to the U.S. Gases businesses.

In addition to the slowdowns in the industrial and manufacturing world, Garvey noted that, “We have seen increases in medical gases, particularly medical O2 in bulk liquid and cylinder O2 in regular large and small clinics and hospitals, and in the setup and equipping of ‘pop-up’ hospitals like the Javits Center in New York City. Those emergency facilities, plus the large increases in ventilator use and intubation in ICU’s increased normal medical O2 use by a factor of five. That severely stretched the production and delivery of O2 to the point of putting under-utilized capacity back in service and in using special portable liquid O2 (LOX) storage and delivery vehicles. There was also a period where the supply of cylinders was severely constrained. Watching the rapid increase in medical O2 and emergency equipment increases in NYC from Feb into May was particularly impressive and showed the real strengths of our gas industry in such trying times.”

According to Garvey, “Helium supply was very tight leading up to the coronavirus pandemic, then hit the skids and went into surplus following the March economic shut-down, as normal end-users curtailed businesses and demand dropped quickly. Demand for some large end-users like MRI did not slow, as manufacturing worked to complete significant backorders. However, the field service side of the MRI business saw a drop off as non-essential surgeries and diagnoses were shut off. The field servicing of the MRI installed base is about two-thirds of helium consumption, so it also declined along with electronics, welding, and analytical/specialty gas for labs dropping off with workers staying home and clinics closed to non-COVID-19 care.”

Interestingly, helium for balloons kept up demand during social distancing because people used helium filled balloons to celebrate graduations and birthdays while keeping socially distant. Garvey noted that, “Helium demand has picked back up, as businesses have slowly opened back up. However, the strong possibility of a resurgence of COVID in the fall means that demand will probably remain down until a safe and widely accessible vaccine is available in early 2021.”

Garvey noted that the CO2 business was also impacted by COVID. “Disruptions to the supply of food-grade CO2 for soft drinks and beer, healthcare and dry ice for food packaging followed reduction in CO2 sourcing from ethanol plants shut down due to a drop in fuel demand caused by the COVID lockdown beginning in March. Some independent industrial gas distributors have also experienced being put on allocation and hit with price increases during the pandemic.”

A coalition, including representatives from multiple food and beverage groups and led by the Compressed Gas Association (CGA), submitted a letter in early April to Vice President Mike Pence expressing strong concern that the current coronavirus pandemic creates a significant risk of a shortage in carbon dioxide (CO2). The coalition requested the assistance of the federal government during the temporary emergency to prevent a substantial CO2 shortage before it creates any food and beverage shortages and significantly other essential sectors of the U.S. economy.

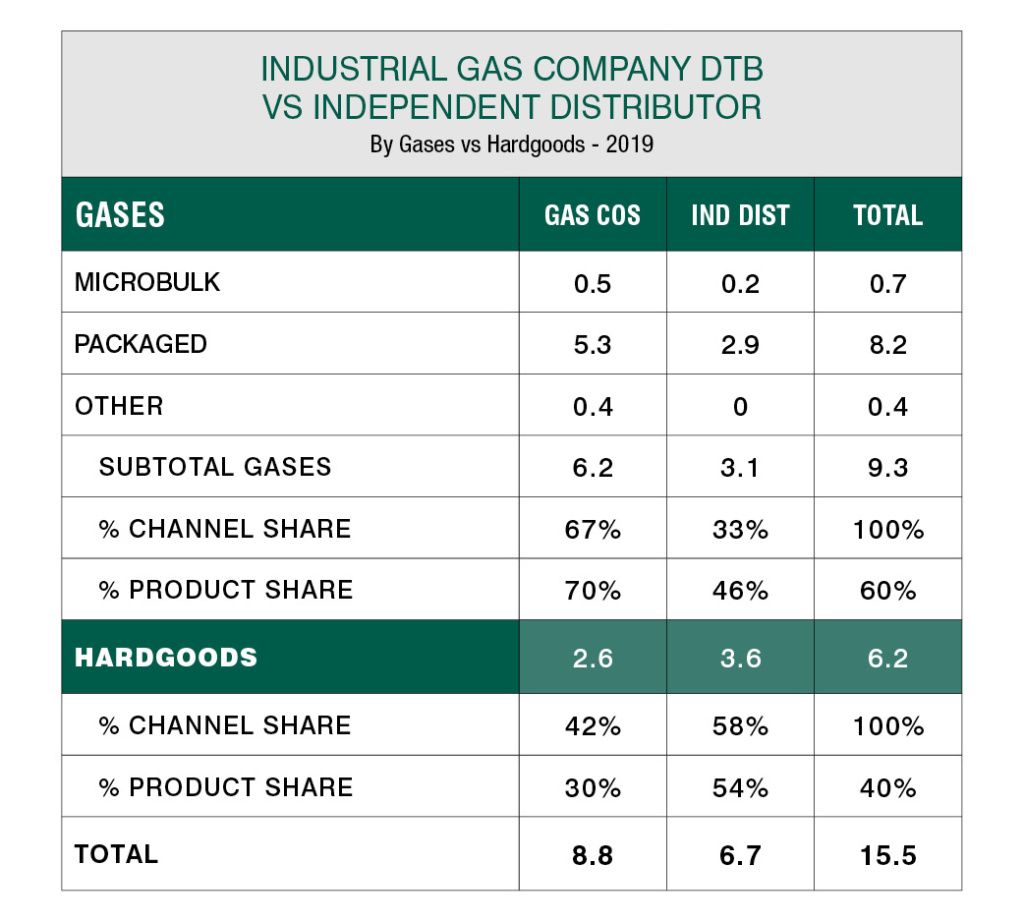

With relevance to U.S. Distributor Type Businesses, Maura briefly describes the U.S. DTB as “representing $9.3B in gases of the $26.5B total U.S. Industrial Gas business with $6.2B from the three major gas producers with strong DTB’s (e.g., Air Liquide, Praxair/Linde, and Matheson) with the remaining $3.1B from Independent Distributors.”

The other part of the DTB is that of welding & cutting (W&C) hardgoods split between the three majors and Independent Distributors, with sales of $2.6B and $3.6B, makes up an estimated total U.S. DTB business of $15.5B (see Table 1). In addition, we estimate that W&C hardgoods sales in the U.S. by small, medium and large W&C manufacturers and the net of U.S. manufacturing and imports is about $11.3B with $4.3B of U.S. manufacturers feeding U.S DTB’s hardgoods sales.

The Baird Survey in July for Q2/20 vs. Q1/20, of the U.S. Welding and Industrial Gas business indicated changes in Sales at the Distributor level of -13% in Hardgoods and -10% in Gases. That, compared with sales changes from Q4/19 to Q1/20 of -0.1% in Hardgoods and +2.5% for Gases. Our discussions with individual distributors on their hardgoods sales from late March reaching into the end of May, with some distributors experiencing sales reduced by as much as 40%.

While April was terrible, a rebound did occur during June and July, restoring about 20%, driven predominately by cylinder and machine rental incomes. Independent packaged gas distributors continue to focus on growing their gases businesses given the uniqueness of those products and their delivery systems, which separate them from the general industrial distribution sector. However, hard goods still remain important to W&C distributors, with those operating incomes underwriting many infrastructure costs. Also, the relationships and connections between hardgoods and gas sales continue to leverage the sales of both. Sadly, the hard goods manufacturing sector did not experience similar recoveries, pressured by both lower end market demand and the reluctance of distributors to replenish inventories, all to protect cash reserves.

On a different tack, we find that the traditional distributor emphasis on “proactive selling and marketing” is shifting to “Safe Order Fulfillment.” During the restrictions of COVID, most distributor retail facilities have been shuttered with customer contacts being accomplished through remote modern media like Zoom. With these new and ever-changing protocols and their lack of effective “face-to-face” contact, the requirements in both selling and service have shifted to increase the reliability of safely providing hardgoods and gases to users with constant all-hands performance. As our businesses rebound, we will see a dramatic change and further development of this new sales methodology.

Recognizing that selling and servicing gas products in cryogenic liquid and gas cylinders is totally different from handling W&C equipment and systems, our hard goods manufacturing and distribution segments should be observing how other SKU-oriented businesses are serving customers under COVID sales and service restrictions . Under COVID, personal contacts by in-person sales and service contacts have become severely limited. So, remote connections of many varieties have been created.

As we have examined, the flow of maintenance, repair, and operations (MRO) products, we see online originated sales representing 60% to 70% of total revenues. With brick and mortar facilities closing, large order taking and distribution centers are being built, with supporting electronic business platforms being expanded in scale and with advanced sophistication at a supersonic rate. In our hardgoods industry, our high-profile capital equipment manufacturers (i.e., Lincoln Electric – Harris, Victor, Rego, etc.) are all moving rapidly to improve their BRAND recognition with online technology and business methods. Sophisticated content models are being built by computer graphics professionals to give online researchers and shoppers the best possible brand image and the most powerful product and performance descriptions to help them differentiate their products from those of their competitors. Our industry’s regional independent distributors must, therefore, consider this type of BRANDING strategy, to improve the remote presentation of their company and products to the rapidly increasing cadre of online buyers.

The ultimate goal is to drive the “cost to serve” as low as possible. In the “perfect world,” the manufacturers’ enterprise resource planning (ERP) will talk seamlessly to the end users’ ERP system with as little human interaction as possible and without losing the traditional positive effect of face-to-face communication. Embedded data will permit research, configuration, all transaction related activity, and invoice payment without human touch point. While Logistics will be a separate third-party logistics (3PL) activity it will also have to be well integrated as a total customer service function. Problems will always occur, but resolution will be accomplished with very sophisticated customer relationship management (CRM) platforms supported by a few highly trained “resolution specialists.”

In such a perfect world, the historically effective industrial supply chain, where the manufacturer is considered as “owner of the product” and the distributor as “owner of the customer” superior total service performance must be maintained in the new world of fast changing and enabling technology. Regardless of the degree of electronic sophistication and more remote communications, the manufacturer will not have the same local presence as the distributor and his high level of “relationship selling.” However, for these supply chain relationships to be preserved and advanced, there must be collaboration between the trading parties of manufacturer, distributor and customer and as much integration as possible between ERP platforms. That will most likely come about by successfully linking evolving application programming interface (API) software. Our industry is at that crossroads today. In recent weeks, possible solutions providers are emerging. Our industry trading partners must pay close attention to those developments.

Buzz Campbell and Ken Thompson represent 118 years of a wide variety of experience in the U.S and international Gases and Welding & Cutting Systems. As an executive and advisor, Ken Thompson has been dedicated for over 60 years to strengthening manufacturers’ and distributors’ supply chain relationships through the sharing of best practices, managing disruptions, and coordinating visions and implementation of systemic technological change to further solid strategic alliances. Since 1962 Campbell has been involved in most parts of the industrial, medical and gases business as a performer, executive and advisor. They are now collaborating on performance improvement projects in the Gases & Hardgoods business.